Bordered by beaches and forested mountains, Sierra Leone’s capital Freetown juts out from the west African coast like an island onto itself. The location makes for idyllic views, but it also isolates the city from the country’s interior — and from its only international airport.

The ferry between the airport and mainland is a critical piece of national infrastructure, serving thousands of Sierra Leonians who can’t afford the fare for more expensive water taxis. Yet for years the line generally ran on two aging and dilapidated crafts that broke down frequently.

The story of how Sierra Leone came to depend on these rickety vessels began more than 2,000 miles away — far from the country’s lush hills, in the oil-rich deserts of Libya, where the former dictator Muammar Gaddafi once dreamed of building a grand pan-African alliance.

The ferries were supposed to help achieve Gaddafi’s vision by investing Libya’s oil wealth in poorer African countries like war-battered Sierra Leone. Instead, the saga became a symbol of the cronyism and nepotism that sapped billions in Libyan public funds under Gaddafi and helped feed the discontent behind the 2011 uprising that toppled him.

Drawing on confidential documents and banking records, as well as court filings in Belgium, OCCRP has discovered how Gaddafi’s brother-in-law, Abdusalam Abulghasem Abughila, a general turned businessman, sat at the heart of what Libyan authorities claim was a scheme to pocket much of the investment set aside to buy the ferry. Journalists also found a separate case in which Abughila’s company was accused of failing to repay a $7-million loan from Libyan authorities.

Together, the cases illustrate the once-murky mechanics of Gaddafi-era graft, and how the consequences of that graft have complicated the struggle for control over the country’s substantial assets in the civil war that followed the dictator’s fall.

The MV Freetown ferry in late 2022.

Foreign assets controlled by Libya’s sovereign wealth fund have often been viewed “as a means of obtaining personal enrichment for elites and a currency of doing political deals,” said Tim Eaton, a researcher at the London-based think tank Chatham House.

“The reason these assets are so desirable is that they provide a route to offshoring money to locations seen as more secure, where it’s safer for their families,” he told OCCRP.

Abughila could not be reached for comment. His lawyer told OCCRP that he could not comment on confidential matters related to a client. Belgian authorities declined to comment. The Libyan state companies involved did not respond to questions.

The Ferry Switcharoo

In the late 1990s, with his dream of achieving unity in the Arab world in tatters, Gaddafi turned to a new vision: pan-Africanism.

As part of this aim, his government launched the Libyan African Investment Portfolio (LAIP) in 2006, with a mandate to invest Libya’s oil wealth into projects across Africa. LAIP subsidiaries set up shop in Ghana, Chad, Liberia, and other countries in Africa.

While the aim was ostensibly to bring economic growth and improve the continent’s infrastructure, in reality the LAIP was used to shore up loyalty among African leaders.

“If you look at its history, it is very political,” Eaton said. He pointed out that the LAIP was only made part of Libya’s sovereign wealth fund, the Libyan Investment Authority, in 2010, and even then was “never meaningfully integrated” within it.

Sierra Leone, recovering from an 11-year civil war and badly in need of foreign investment, looked like a perfect destination for LAIP investment. And Libya already had a presence there: In 2004, Tripoli had provided a ferry to Sierra Leone, the MV Murzuk.

Passengers boarding the MV Murzuk ferry in 2022.

The ferry was operated by Afrimpex Navigation Co. Ltd., the local subsidiary of a Maltese company of the same name, which Gaddafi’s relative Abughila controlled. In March 2008, Abughila wrote to LAIP to recommend that a second ferry be added to the line to reduce the burden on the first boat.

LAIP went into business with Abughila, the husband of Gaddafi's first wife’s sister, agreeing to invest $4 million to purchase a new ferry and to become his partner in a new version of Afrimpex which Abughila had already incorporated in Belgium.

Abughila owned three-quarters of the Belgian Afrimpex, while an LAIP subsidiary called the Libyan African Investment Company (LAICO) owned the rest, making the state fund an official partner in the venture.

The deal was signed in June 2008 by LAIP’s general manager, Bashir Saleh Bashir, who was often known as “Gaddafi’s banker” and hailed from the same southern Libyan region as Abughila. The terms stipulated that the Belgian Afrimpex would procure the ferry, operate it, and pay 60 percent of the net profits to LAIP each year, while LAIP would own the ferry since it had put up the money for it.

But instead, the $4 million sent by LAIP to buy the ferry was deposited into Abughila’s personal bank account in Malta, not an Afrimpex company bank account.

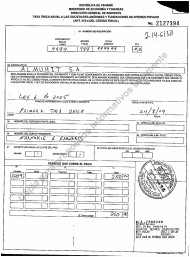

The ferry was then purchased through Almuhit, an offshore company in Panama controlled by Abhughila, rather than Afrimpex, according to documents obtained by OCCRP and a filing by LAIP to a Belgian court.

Although $4 million had been allocated for the purchase, bank statements showed that Abughila paid just 1.75 million euros ($2.6 million) for the boat, sent in two installments, one from his personal bank account and one via the offshore company. In the physical delivery statement for the boat, the owner of the asset was listed as Almuhit — not LAIP, as had been agreed.

Shortly after the payment, Abughila drew up an agreement for the Malta-registered Afrimpex Navigation Co. Ltd. to lease the ferry from Almuhit for $120,000 a year from 2010 through 2014.

This means that not only had Abughila allegedly siphoned off $1.4 million from the money sent to him by the Libyan government to buy the ferry, but he also secretly arranged for his own offshore company to own the vessel and to make money by leasing it back to Afrimpex. (It’s unclear why he used the Malta-registered Afrimpex for this.)

A lawyer for Afrimpex declined to comment. Abughila could not be reached for comment.

How the Money Moved

Factional Conflict

In 2012, the year after Gaddafi’s fall, Libya’s interim government appointed a new chief to oversee Libya’s sovereign wealth fund. He launched multiple investigations into alleged Gaddafi-era corruption.

For a while, it looked like Abughila might face a reckoning. In November 2014, after having commissioned a private investigation into the ferry’s ownership, LAIP discovered that the funds for the ferry had been paid into Abughila’s private accounts. LAICO had also been asking for the Belgian Afrimpex for payments on a $7-million loan the fund had extended to the company in 2007, which it was supposed to be paying back with interest.

But then Libyan politics swerved again, introducing yet another twist into the ferry saga — and taking the heat off Abughila.

Libya began descending into a new round of civil war. Rival political factions, backed by different militias, began to struggle for dominance, effectively splitting the country in two. Rival versions of state institutions also emerged.

The Libyan Investment Authority’s leadership decamped for Malta — and then, in 2015, another leadership emerged in Tripoli and began to vie for legitimacy. Different sets of claimants also emerged for both LAIP and LAICO, some in Malta and some in Tripoli, often with unclear and shifting allegiances and relationships to one another.

Anas El Gomati, founder of the Sadeq Institute, a Libya-focused think tank, told OCCRP that the divisions within Libya’s sovereign wealth fund “gave time and plausible deniability for countries, companies and hedge funds that have misappropriated Libya's funds to be able to instrumentalize Libya’s crises.”

“This division also accelerated an economic phenomenon that was already in place,” he added. “Corruption.”

In the midst of these leadership disputes, one faction of LAICO officers agreed to buy out Abughila's shares in Afrimpex. A rival group then challenged the move, sparking a court case in Belgium when they filed a request for Belgium’s KBC Bank S.A. to freeze Afrimpex’s accounts. They asked the bank to seize the $4 million that had been paid by the Libyan government for the ferry, as well as the $7 million loan Afrimpex had never repaid.

“This division [within Libya’s sovereign wealth fund] also accelerated an economic phenomenon that was already in place: Corruption.”

Anas El Gomati

Founder of the Sadeq Institute

Still further divisions continued on the ground in Libya, and in 2019 another set of officials began arguing that they were in fact the legitimate successors to the LAICO that had loaned out the money. These eastern officials wrote to Belgian officials warning them to watch out for “impersonating companies” who were trying to “loot Libyan funds abroad.”

The intense factionalization in Libya “changed the priority of the Libyan Investment Authority and its subsidiaries from ensuring their continued growth, or at least the stability of Libya's public assets, and the deeper question … — has there been any illegal use of Libya's funds? — to a new question: the legitimacy of the Libyan body asking the questions,” Gomati said.

Amid the chaos, Abughila sealed the buyout deal with one version of LAICO. This netted him one last payout: He received 450,000 euros as a settlement for unpaid salaries and remunerations due to him. It is not clear how much was paid for Afrimpex’s shares.

An early agreement showed that LAIP was also supposed to take over the Freetown ferry, which was owned by the Abughila-controlled Almuhit, but it is not clear how this worked in the final arrangement. Today both the Freetown and Murzuk are operated by the Sierra Leone-registered Afrimpex Navigation, which is ultimately owned by LAICO, although the exact ownership structure of the ferries is unclear.

Abughila did not respond to multiple requests for comment, and his current whereabouts are unknown. Ibrahim El-Danfour, the LAICO official who cut the deal with Abughila, defended the buyout, saying that LAICO had been prevented from playing an active role in Afrimpex — or recovering the interest on its $7 million loan — because Abughila had taken “unilateral control” of the joint venture amid the chaos of the past few years.

“We believe that buying Abug[h]ila out was the right move,” he said.

However, his rivals have insisted that his status as head of LAICO was illegitimate, and that he had no right to cut the deal. As recently as 2020, a representative of an opposing faction wrote to Belgian authorities to complain about the share buyout, and once again sought a freeze of Afrimpex’s assets.

But their claims don’t appear to have led to a resolution. The Belgian court cases are now dormant, having been taken off the docket since neither party to the dispute has filed a motion for several years.

As for the ferry at the heart of the fight, the MV Freetown showed signs of deterioration for years, due partly to an apparent lack of maintenance. A breakdown in 2019 left passengers stranded on the water for more than five hours, according to local media.

The MV Freetown showed signs of age and disrepair in 2022.

The ferry finally underwent repairs in mid-2020, but it continued to experience difficulties, and was sent to a junkyard. That left travelers dependent on vessels such as the other Libyan ferry, the MV Murzuk, which is now over three decades old.

The MV Freetown did continue to serve some use — although not as it was intended. Resting in a junkyard on the outskirts of the capital, the ferry had apparently become a home to squatters. When a reporter visited the site in November, he found clothes drying on the hull. Before he could get any closer, however, Afrimpex’s manager arrived and he was asked to leave.

The dilapidated Freetown was put into operation again not long after that, but quickly broke down again, stranding passengers at sea for hours in March, according to local media.