Controversial former banker Álvaro Sobrinho is under investigation in Portugal for allegedly embezzling hundreds of millions of dollars in taxpayers’ money through a Portuguese-owned bank he led in Angola, which was dismantled in 2014 after running up unexplained multi-billion-dollar debts.

Now, new documents and testimony reveal a scheme seemingly designed to allow Sobrinho’s bank to manage and potentially siphon off hundreds of millions of dollars in government-backed money intended for a housing project in 2009. It is unclear whether the scheme was successful.

An official Angolan intelligence report alleged money for the housing had been transferred through financial institutions in Europe, while the CEO of the company supposed to build the houses claims Sobrinho and his associates stole funds connected to the project.

Records from the Suisse Secrets leak show Sobrinho set up several accounts at Credit Suisse around the time the scheme was attempted. In total he had 12 accounts in the Suisse Secrets data, with the largest of them holding 78 million Swiss francs. At least 11 of these accounts are being investigated by Portuguese prosecutors, according to documents seen by reporters.

Sobrinho denied stealing any funds. He claimed the financing for the project was canceled and no loans were ever disbursed.

The Suisse Secrets Investigation

Suisse Secrets is a collaborative journalism project based on leaked bank account data from Swiss banking giant Credit Suisse.

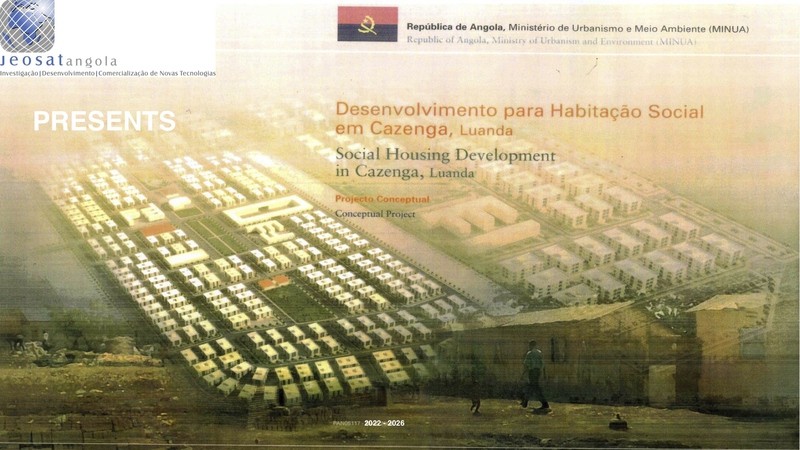

Banco Espírito Santo Angola (BESA) was central in attempts to set up complex financing arrangements for the housing project, which was supposed to result in one million new low-cost homes intended largely for war veterans in Cazenga, near the Angolan capital of Luanda. In the end, the houses were never built.

The project was ultimately underwritten by the Angolan state, which agreed to grant a local construction company a government-backed credit line of 750 million euros to build the houses. But Sobrinho’s BESA was meant to play a key role in arranging, holding, and managing the funds.

The former head of Angola’s National Agency for Private Investment was critical of Sobrinho’s management of the process, according to a 2010 letter obtained by OCCRP.

Aguinaldo Jaime, the agency’s president at the time, wrote to Sobrinho to describe “legitimate concern” over how BESA was trying to handle the money for the housing project. The letter rebuked Sobrinho for attempting to inappropriately include third parties in the deal, creating the risk that public money would be lost.

The head of Jeosat Angola, the company that was supposed to build the houses, says he has filed complaints with U.S. and EU authorities alleging that BESA officials convinced him to set up an offshore company in the British Virgin Islands, also called Jeosat Angola, to receive the money for the construction project.

Carlos Rodrigues, Jeosat’s CEO, told OCCRP that he initially trusted Sobrinho and his deputies at BESA when they told him that it would be better to use offshore structures.

But then, Rodrigues claimed, they stopped communicating with him, took control over the offshore, stole his identity, and used it to set up other shell companies and bank accounts. He alleges this offshore setup was then used to drain the 750-million-euro credit line.

Rodrigues says the housing project was never built because of BESA’s deliberate efforts to undermine Jeosat’s access to financing.

“They used the entire credit line and put me in debt that I was never even told about,” Rodrigues said. He said he could not provide documentary evidence of his debt or of the credit line being used, saying the information was confidential and sharing it could jeopardize his legal case.

Bad Credit

The financing proposition for the housing project was complex.

BESA took the lead in building a consortium of banks to finance the deal, based on guarantees from the Angolan government. But it largely outsourced this work to Swiss financial management firm Weyhill, which was brought on board to identify European banks that could finance the project, then help manage the loans. Money for the project was to be disbursed in three tranches from banks in France and Liechtenstein through Weyhill and another financial management company, and would eventually be sent on to Jeosat in Angola, which had its account at BESA.

Documents indicate that, at least at one stage, BESA was in line to receive a 30 percent commission for its role in this deal, equivalent to 225 million euros, although OCCRP could not verify whether this was ever paid out.

Letters and contracts obtained by OCCRP reveal disagreements among the consortium members from the very start. In April 2010, Thomas Sundell, the CEO of Weyhill, wrote a frustrated letter to Angolan President José Eduardo dos Santos. He complained that BESA officials had tried to convince Weyhill to pay the entire amount earmarked for the housing project — 750 million euros — to an Espírito Santo account in Dubai.

Sundell said he refused, so BESA executives tried instead to have the first tranche of financing — 250 million euros — sent to an account at BESA’s parent bank, Banco Espírito Santo in Lisbon.

“[W]e refused as there would be no money left to be sent to Angola [for the housing project],” Sundell wrote.

Sundell said BESA had sent “many pseudo-guarantees” throughout the process.

”What we understand they were trying to do … was getting this money for free from our institution and give it as a loan to Angola with high interest rates.”

Thomas Sundell

CEO, Swiss financial mangement company Weyhill

“What we understand they were trying to do, His Excellency, was getting this money for free from our institution and give it as a loan to Angola with high interest rates,” Sundell wrote.

Even as all this was taking place, Rodrigues claims Sobrinho was engaging in offshore machinations. According to documents Rodrigues provided to OCCRP, a company called Jeosat Angola was created in the British Virgin Islands in September 2009.

Less than two weeks later, the Dubai outpost of Banco Espírito Santo wrote to Sobrinho’s assistant to say the offshore company had been set up and arrangements had been made for Sobrinho to be granted power of attorney over it, which would allow him to set up a bank account in Dubai in Jeosat’s name. A contract annex on BESA letterhead confirms the Dubai account was opened, with BESA and Jeosat listed as co-signatories. OCCRP could not confirm whether any money was ever paid into the account.

Rodrigues says he initially gave his approval for all this, but soon found he had no control over the offshore company that bore Jeosat’s name.

Asked about Rodrigues’s claim, Sobrinho told reporters he should address his concerns to the Dubai bank, which was liquidated in 2014 with the collapse of Banco Espírito Santo. He said accusations that Jeosat money had been stolen were not correct, and that Jeosat opened an account at BESA because the bank’s parent, Banco Espírito Santo, “had the international reputation.”

Sobrinho also insisted that BESA never received a fee or commission for its work, and claimed the housing project did not go ahead because international financial institutions refused to fund it. He said no funds for the project were ever disbursed.

Sobrinho told OCCRP the sovereign guarantee was voided by the Ministry of Finance on April 30, 2010, and provided a signed letter from the ministry as proof. OCCRP could find no evidence the sovereign guarantee was actually voided, and according to evidence presented in court in another case, only the Angolan president can void a sovereign guarantee. Jaime’s letter from Angola’s investment agency’s to Sobrinho, sent four days later on May 3, 2010, makes no mention of cancellation and discusses ongoing work. BESA representatives were still discussing the financing with European bankers in emails from June 2010.

While it is true that the European banks involved do not appear to have sent any money for the project, internal bank records obtained by OCCRP show $20 million loaned to Jeosat’s BESA account months after the alleged April 2010 revocation, and movement of other funds at BESA for Jeosat at the same time. It is unclear where this money ended up.

Jeosat’s U.S. dollar BESA account statement shows just over $20 million was loaned to the company on August 9, 2010. The money was immediately transferred out to an unknown beneficiary. The rest of the entries on the statement relate to loan fees, rather than normal payments to suppliers that might be expected for a construction company.

A separate BESA bank statement shows a 309.8 million credit entering the bank on the same day as the $20 million was loaned to Jeosat. (The currency is not specified and may have been U.S. dollars, euros, or Angolan kwanza.) A notes field shows that it is earmarked for Jeosat. The same day, 301.6 million is debited from the account as an internal transfer, ostensibly for “amortization of debt.” It is unclear where it was sent, but Rodrigues said that Jeosat never received this money, and company bank statements seen by reporters show no evidence of it being paid in.

Sobrinho declined to comment on the funds earmarked for Jeosat.The Angolan Ministry of Finance and Central Bank did not respond to questions about the sovereign guarantee.

Suspect Accounts

In December 2009, just a few months after the offshore Jeosat Angola had been set up in the British Virgin Islands, Sobrinho opened three accounts at Credit Suisse. By April 2010, the largest of these accounts contained over 78 million Swiss francs (over $72 million).

Sobrinho opened the three accounts shortly after a meeting in Zurich between Weyhill and other financiers of the Jeosat construction project, according to emails and documents obtained by OCCRP. All of them are now being investigated as part of the Portuguese probe into embezzlement and money laundering at BESA, according to documents obtained by reporters.

He opened another nine Credit Suisse accounts over the course of 2010 and 2011. Co-owners of the accounts included Espírito Santo senior executive Helder Bagaglia and a person named Emmanuel Sobrinho Madelino, who may be Sobrinho’s brother. (His brother is named Emanuel Jorge Alves Madaleno.) All but one of these accounts are also being investigated by Portuguese prosecutors.

It’s unclear whether the funds in the Credit Suisse accounts were directly related to the Jeosat project. OCCRP could find no direct payments to Sobrinho in documents and bank statements related to the Jeosat case.

Sobrinho denied knowledge of a meeting in Zurich. He said he had not held joint accounts with Bataglia or his brother, and that questions about his Credit Suisse accounts had been “publicly investigated by Swiss authorit[ies] since 2012.”

Credit Suisse “know[s] very well why my accounts [were] opened and where my funds came in,” Sobrinho said in an email to reporters.

Credit Suisse declined to answer specific questions about clients, saying it was aware of its responsibility to adhere to the “highest standards” and that it operates in compliance with all laws and regulations at home and abroad.

“In recent years the bank has taken a series of significant measures in line with Swiss financial reforms, including considerable investment specifically in compliance and combating financial crime,” Credit Suisse said.

Culture of Corruption

In 2013, while investigating BESA’s massive debt, Angola’s intelligence services found that unnamed “high [ranking] personalities” had transferred Jeosat’s money through foreign financial institutions in Europe and set up fictitious accounts, according to a report obtained by OCCRP.

The report does not mention Sobrinho by name, but it does appear to clear Jeosat, indicating Rodrigues had no knowledge of what was happening.

As BESA fell apart in 2014, Angola stepped in to rescue it by guaranteeing $5.7 billion of BESA’s non-performing debts. (Sobrinho claimed BESA did not collapse and was instead subject to “an illegal takeover.”) But that guarantee was withdrawn when BESA's parent company, Banco Espírito Santo, also went bust. KPMG, the auditing firm that had repeatedly given BESA and its parent a clean bill of health, had little idea of who ended up with the money, according to media reports.

“It is clear to everyone that BESA was used to fund the Angolan kleptocracy,” said Karina Carvalho, director of Transparency International in Portugal. “No one is accountable, and no one seems to care.

Rodrigues blamed a culture of corruption among Angolan politicians, and said other officials likely also benefited from the siphoning off of housing funds, which explained why they didn’t react to his letters.

“They all took the money,” Rodrigues told OCCRP.

CORRECTION: This story has been updated to correct a description of a bank account.