One of Pakistan’s richest men has long maintained that he had nothing to do with the purchase of a five-star London hotel in a deal under investigation for possible forgery, tax fraud, and money laundering.

But bank records obtained by OCCRP and its partners in the Suisse Secrets investigation may have linked him to the hotel acquisition. Leaked data from Credit Suisse reveals that the wealthy businessman, Mian Mohammad Mansha, appears to have held a joint bank account with a mysterious company that helped finance the deal.

The Suisse Secrets Investigation

Suisse Secrets is a collaborative journalism project based on leaked bank account data from Swiss banking giant Credit Suisse.

Tax authorities in Pakistan began investigating Mansha and other members of his family in 2015 after they came to suspect irregularities in the purchase of the historic St. James Hotel & Club in November 2010 for around $50 million.

Mansha has insisted he has no interest in the hotel, which is owned by his sons, Umer and Hassan, and daughter-in-law, Ammil Raza Mansha. They claimed to have financed the purchase with $22 million borrowed from an obscure offshore company in the British Virgin Islands, and $20 million borrowed from another company in the British Crown dependency of Guernsey. The Manshas said the Guernsey company was called Easy Investments Limited.

Both loan agreements were signed by Hassan Mansha and witnessed by Muazzam Rashid, an assistant manager at a Mansha family-owned business in Pakistan, according to court documents.

The Pakistani Federal Board of Revenue started looking into the deal after coming to suspect that the family had moved funds out of the country without declaring them. But the inquiry soon reached a dead end, since investigators couldn’t learn much about the offshore companies that supposedly lent the money.

British Virgin Islands officials didn’t provide any information about the company registered there, Avendale Enterprises Limited, which had lent the Manshas $22 million. Guernsey officials were more helpful, but their response when queried about Easy Investments Limited raised red flags. They said there was no record of the company ever having been registered on the island. Pakistani investigators didn’t find a trace of it anywhere else in the world, either.

In court papers filed in 2020, the Federal Board of Revenue argued that Guernsey's lack of a registration for Easy Investments rendered the multi-million-dollar loan suspicious and raised “serious questions regarding the veracity of the claims of members of the Mansha family.”

Now, Suisse Secrets data suggests that Mansha may have had a close tie to Easy Investments. A company controlled by Mansha and his wife, Naz, opened a bank account at Credit Suisse in 2005 that named Easy Investments Limited as a co-holder.

The account, which was closed in 2013, had a maximum balance of around 18.5 million Swiss francs (about $20 million) in 2012, more than a year after the hotel deal was concluded.

It can’t be definitively proven that the company listed on the bank account is the same as the offshore that loaned the Mansha family money, since Suisse Secrets data does not include the jurisdictions where corporations are registered. Reporters found a handful of companies named Easy Investments Limited registered at the time of the deal in other jurisdictions around the world, but either their ownership could not be identified, or they did not appear to be connected to the deal.

But Maira Martini, a policy expert at Transparency International, said the Suisse Secrets data indicated that Mansha must have a close relationship with a company called Easy Investments Limited.

“It would not be possible for somebody else to be listed as the [co-]owner of your account if you don't have anything to do with them and you've never met them,” she said. “Everything in the account belongs to both of you.”

Lawyers for the Manshas have challenged the tax agency’s jurisdiction because Residentia Holdings PTE Limited, the parent company of the corporate owner of the hotel, is a foreign entity. They also questioned the jurisdiction of the National Accountability Bureau, which is pursuing a separate case over suspicion that the deal involved money laundering.

But the new revelation about Easy Investments could change the course of these investigations.

If Mansha secretly owned the company and lied to investigators about it, he could be on the hook for serious financial penalties — and even perjury charges, a tax official who worked on the investigation told OCCRP.

“If the information is supported by documentary evidence, then he will have to pay the relevant taxes plus penalties on the evaded amount,” said Haroon Muhammad Khan Tareen, who launched the Mansha investigation in 2015 but is now retired.

“He may also face criminal prosecution for concealment,” added Khan Tareen.

Mansha did not respond to questions from journalists. Neither he nor his family members have been charged with any crimes related to the deals.

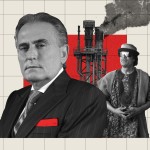

Mansha recently stepped down as chairman of Nishat Group, a conglomerate founded by his father and uncles in 1951. In 2010 he became the first Pakistani to make the Forbes list of billionaires.

Mansha’s businesses expanded in the 1990s, when, thanks to a privatization drive led by Prime Minister Mian Nawaz Sharif, he acquired stakes in two cement companies and was part of a consortium that bought Muslim Commercial Bank, one of Pakistan’s largest.

Questions are still being raised about the acquisition of the bank. The bid from Mansha’s consortium of 12 partners was not the highest submitted, but he was allowed to match the high bid to win the auction. A NAB inquiry launched in 2002 remains open.

Sharif came under investigation after the Panama Papers revealed that several of his children are secret beneficial owners of luxury apartments in London.