Back in the early 2010s, Gursamarjit Singh was thriving. His start-up company, IndiaHomes, was promising to “revolutionize” India’s real estate market by offering tech-led, online-only property sales services. As the business prospered, Singh himself amassed a property portfolio in India and the U.K. worth millions of dollars.

But in April 2015, Singh stepped down as the firm’s operational managing director during a property market crash. The next year, IndiaHomes went out of business, leaving scores of customers out of pocket. Singh then resigned as the company’s registered director.

By that point, Singh had given up his Indian citizenship and purchased a passport from Dominica, a Caribbean island nation that sells its citizenship around the world. With the global access offered by his new nationality, Singh left his former life behind, and moved to the U.K. He started using his nickname, “Sam” Singh, became a major Conservative party donor, and bought a mansion now on sale for about $10 million.

OCCRP has obtained a cache of documents detailing Singh’s business affairs, including bank statements, company documents, and invoices. Together with newly available legal and corporate records, they show how transnational elites can use so-called “golden passports,” coupled with financial tools such as offshore trusts, to move money, travel, and build a new life abroad.

Last year, Indian police issued a so-called “Look Out Circular” against Singh, following a complaint alleging fraud filed by his sister-in-law in India. The circular requires authorities to watch for him at border crossings and arrest or detain him for questioning if he enters the country, according to two Indian lawyers. Police have not formally filed charges, but online records show the complaint is still open.

In a response to a request for comment, a Delhi-based lawyer for Singh denied the allegations and told OCCRP that “the Look Out Circular relates to an unfortunate private familial dispute between our client and his sister-in-law who has personal enmity against him.”

Meanwhile, scores of IndiaHomes customers have banded together online for years to complain that the company short-changed them. No legal action has been taken against Singh or the company over the complaints, which Singh denies.

Singh has long since been set up in the U.K., where he has bought high-end property and established companies using his new nationality, and mingled among high society.

Singh’s lawyer told OCCRP that IndiaHomes was “a successful venture” and “all the decisions were taken by the executives / board of the Company and not by our client.” The lawyer added that IndiaHomes was “a multi-investor and multi-director company and the [sic] all the decisions were taken by the executives / board of the Company and not by our client.”

The lawyer said “there is no doubt or lack of clarity” as to whether Singh had “the financial ability to buy properties or invest in any other businesses and there is no legal restriction on the same.” The lawyer said that Singh’s Dominica citizenship was acquired “with the purpose of easing business travel and avoiding lengthy delays for cumbersome visa restrictions.”

‘On Your Side’

Singh’s online real estate agency, IndiaHomes, framed itself as a tech-driven innovator in the country’s rapidly expanding property market. One TV advertisement opened with quickfire shots of unscrupulous real estate agents laughing menacingly into the camera while waving wads of cash. Unlike those crooks, the ad assured viewers, IndiaHomes was “on your side.”

IndiaHomes worked by getting discounts from construction companies — usually between one and 2.5 percent of the property’s value — and promising to pass the savings on to customers. In one case, the company promised a discount of about $2,500, one percent of the value of a roughly $250,000 property sale. However, the buyer said he never received the discount. (Singh’s lawyer said that: “During his tenure (at the firm), IndiaHomes never issued any passback or discounting payments to anyone.”)

When customers bought their homes, they received “credit notes,” which IndiaHomes pledged to redeem. But, crucially, the customers needed to pay the full price up-front before claiming the discounts.

Scores of customers have said that, once the money was paid, they were not able to get their money from IndiaHomes. Extensive complaints against the company appeared on India’s National Consumer Complaint forum, while homebuyers banded together informally in WhatsApp groups and online forums to try to get their discounts.

One customer, Sumit Gautam, made a complaint to the Ministry of Consumer Affairs, writing that “after more than five years and consistent follow up… we have still not received this brokerage discount.”

“My humble request [is] to please take appropriate action against IndiaHomes,” he wrote.

No legal action has been brought against IndiaHomes over the accusations, which Singh’s lawyers said he “categorically denies.” Singh’s India-based lawyers said that the accusations — which were reported extensively in openDemocracy in 2021 — were “baseless and denied in toto.”

Singh’s lawyers said openDemocracy was subject to an ongoing investigation by New Delhi police over the article. The publication said it had received no notice of the investigation.

OCCRP obtained nine credit notes dated between 2011 and 2015, which had either been posted online or provided to reporters by customers who said they had not been paid the money they were owed. One note, dated Jan. 20, 2015, said that IndiaHomes’ parent company, India World Technologies Pvt. Ltd., “reserves the right in its absolute discretion to amend the terms and conditions any time without prior information.”

By 2014, India’s property market had slowed down. As IndiaHomes started struggling, Singh was spending. A document outlining the company’s response to a due diligence report commissioned by shareholders showed that auditors flagged several of Singh’s expenditures that year. The document indicates the auditors had found “unsatisfactory supportings” for payments worth around $160,000 to a life coach, the online retailer Amazon, as well as travel, hotel, and entertainment expenses.

The same report stated that IndiaHomes “uses Marketing Agencies to disburse and manage passbacks and discounting payments.” It added that around $700,000 worth of discounts were “pending disbursal post collection” at the end of 2014, indicating IndiaHomes was in possession of funds that were due to be paid out. It is not clear how much of this money was ever paid out.

In April 2015, Singh stepped down as managing director of the company but retained his shareholding.

IndiaHomes announced in April 2016 that it had stopped business activities. The company was not closed down, however, but instead was placed under the ownership of successive offshore companies in Mauritius and the United Arab Emirates. Corporate registries do not say who owns these companies. Singh still held his shares in IndiaHomes as recently as 2019, according to Indian company filings.

Legally Dominican

While at IndiaHomes, Singh had been laying the groundwork for a life beyond India.

On March 27, 2013, Singh paid $104,765 to legally obtain a Dominican passport — which required him to give up his Indian nationality under Indian law prohibiting dual citizenship. The new Dominica passport allowed travel to 130 countries without a visa or with a visa on arrival, as well as the possibility of obtaining a 10-year U.S. visa.

Singh had also been buying properties in the U.K. In 2012, property records show, he bought a house in Buckinghamshire in the U.K. for about 3.1 million British pounds (around $4 million) via a British Virgin Islands company, Linkfield Group Ltd, with part of the cost covered by a mortgage from ABN Amro bank in the Channel Islands.

The offshore company Linkfield also held an investment portfolio of stocks and bonds, through a Barclays Bank account in Singapore, worth nearly $5 million, bank statements obtained by OCCRP show. (Reporters cross-referenced foreign exchange rates during the dates mentioned in the statements and checked the Buckinghamshire property investment against public records.)

In 2015, using his Dominican citizenship, Singh added Hinwick House — an 18-bedroom home modeled on the original Buckingham Palace — to his property portfolio for another 4 million pounds (about $6 million at the time).

As well as the U.K. property, Singh also began integrating himself into elevated British social circles. Between 2014 and 2019, he donated a little over 270,000 pounds to the ruling Conservative Party, financial disclosures show. He has not donated anything since then.

In 2016, Singh was named a trustee of the Elephant Family, a wildlife charity that counts King Charles and Queen Camilla as its so-called Royal Presidents.

Queen Camilla’s nephew, the recently knighted Sir Ben Elliot, became a director of Singh’s newly-formed British business, Real World Technologies Ltd, in April 2017. Elliot was chairman of the Conservative Party for three years between 2019 and 2022. Former Conservative member of parliament Baroness Kate Rock was also on the Real World board of directors. (Elliot and Rock did not respond to requests for comment.)

The business said it would use artificial intelligence to offer state-of-the-art online real estate services. As of last year, the company had just 20 pounds in cash assets, and was owed just over 10,000 pounds, company financial statements show. Its books say it has zero employees.

Elliott resigned from his position in 2019, and the baroness stepped down early the next year. The company’s subsidiary now does business as an online estate agent operating in Dubai named “Memorable.”

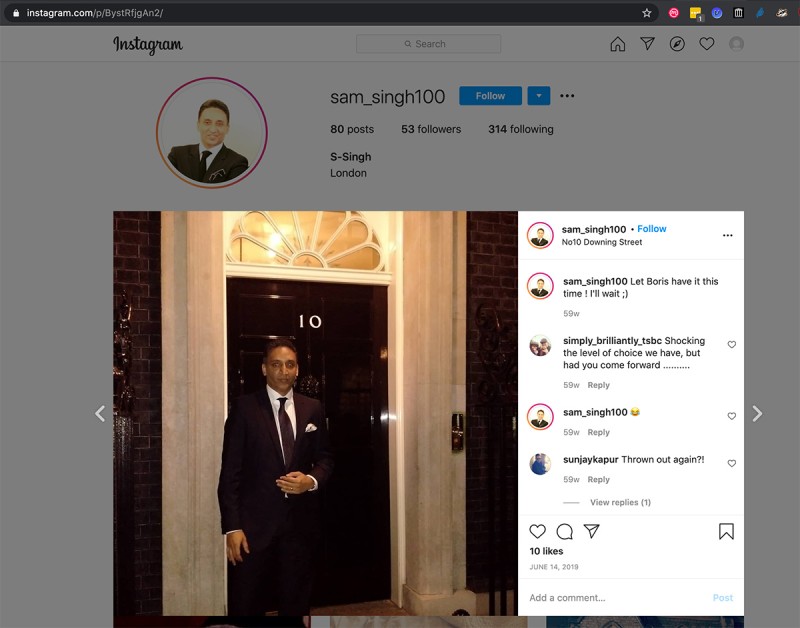

After making his UK move, the IndiaHomes founder collected photos of himself pheasant shooting, standing outside 10 Downing Street, and smiling alongside Theresa May and Boris Johnson, two Tory party leaders who would both later become prime ministers. Johnson even signed the visitors book at Hinwick House, according to a photo Singh posted on his now-private Instagram account.

May and Johnson did not respond to requests for comment.

Singh’s ‘Capo di Capi’

‘Winning in India’

At a glamorous launch event in May 2014 for his book “Winning in India” — a compendium of business lessons by India’s top entrepreneurs, including Singh himself — Singh talked of the importance of family. His presentation included a sign stating, “family is the raison d’etre for Indians.”

At the same time, Singh was engaged in financial dealings with his own family that would eventually lead to a heated legal dispute.

In 2021, his brother’s wife, Priyanka Singh, filed a civil lawsuit against Singh in the Delhi High Court, seeking the equivalent of about $2.3 million in damages. In her complaint, she said she had transferred around $1.4 million to three of his companies in 2013. Priyanka became a director in all three firms. But she had little control over the companies and was “merely made to sign some documents,” she said in her complaint.

Priyanka declined to comment.

In her claim — which includes bank statements, emails from Singh, and his legal response — Priyanka said that Singh had told her that her money would be put into a “safe investment” of property for around seven or eight years. She said she was told her money would triple in that time, but in reality received nothing besides one payment in May 2019 and lost her original stake. Priyanka accused Singh of “seeking to fritter away” her assets “by parking them in shell companies, some of them on foreign soil.”

Priyanka said in her claim that Singh paid her 5 million rupees, worth roughly $70,000 at the time of payment in May 2019, but nothing else.

By the time she launched legal action against him, Singh had cut her off, an email exchange submitted as an exhibit in the case shows. In one message to Priyanka the year before, as the two were arguing over the return of her investment, Singh had described her allegations as “naive and ludicrous.”

In a legal response to her complaint, Singh said her allegations were “wrong, frivolous and misconceived.” He admitted he has not returned her money to her, but blamed a downturn in the property market.

The lawyer for Singh denied that the email exchange submitted as part of the court case was real, and said the emails were part of a “smear campaign” launched by his sister-in-law.

The case is ongoing and no judgment has been issued. Priyanka has also filed a criminal complaint to Indian police. That complaint remains open, though police have not filed formal charges.

Singh currently splits his time between the U.K. and United Arab Emirates, according to his LinkedIn profile. He is running a new property venture focused on artificial intelligence and styles himself as a “serial entrepreneur.”

Before the U.K. move, Singh’s book had offered pearls of wisdom, including “flamboyance is admired, but rarely rewarded.” He is now trying to sell Hinwick House, which is listed for nearly 8 million pounds.