The Colón Free Trade Zone advertises itself as “a commercial showcase par excellence,” offering exporters an endless array of tax-free goods shipped from around the world to this bustling city at the mouth of the Panama Canal.

It’s also “the Disneyland of smuggling,” according to Daniel Rico, a Colombian expert on criminal economies. “Whisky, cigarettes, medicines –– everything.”

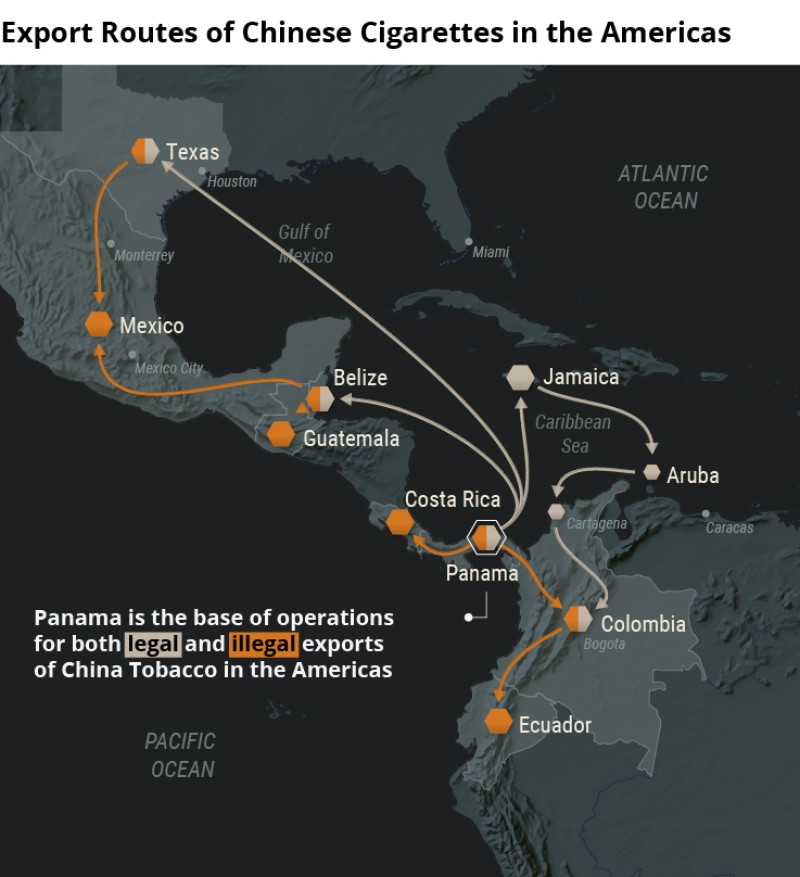

Now, reporters have uncovered a Panama-based network of shell companies sending huge amounts of Chinese cigarettes from the free zone into Latin American countries where there is no legal market for them. The firms have ties to China’s massive state-owned tobacco company, and are selling to accused smugglers.

The China National Tobacco Corporation (CNTC) is by far the world’s largest cigarette company. It controls almost half the global market, selling most of its cigarettes to the approximately 300 million smokers in China. But the sprawling conglomerate –– often referred to simply as China Tobacco –– is angling for an even larger share, and it has been forging new markets from Africa to Europe.

Smuggling is an important part of that strategy, experts say, and Panama has emerged as a key staging point for China Tobacco’s push into Latin America.

Journalists from OCCRP and its partners, Colombia’s Cuestión Pública and Revista Concolón in Panama, found that CNTC cigarettes have flooded into countries from Mexico to Ecuador. The writing on the packs is Spanish, suggesting that they are made specifically for Latin American markets –– even though Chile seems to be the only country where it’s legal to sell them.

In using this strategy, CNTC is taking a leaf from the playbook of “Big Tobacco,” shorthand for the group of companies that has long dominated the global trade: British American Tobacco (BAT), Imperial Brands, Japan Tobacco International, and Philip Morris International (PMI), which owns Marlboro.

In the 1990s, Rico recalled, packs of Marlboro began pouring into Colombia, undercutting and eventually dominating local brands. Then PMI negotiated with Colombia’s National Tax and Customs Directorate (DIAN).

“One day they went and told the DIAN that they wanted to legalize, but they already had the whole market under control,” said Rico, who is director of the research firm C-Analisis. “Smuggling is a way to expand the market.”

About This Investigation

Loose Regulations

Colombia is awash with illegal cigarettes once again. But instead of Marlboros, the packs carry names like Golden Deer and Silver Elephant, along with other CNTC brands.

In July 2020, authorities busted a huge shipment of Chinese cigarettes, confiscating almost enough for each of Colombia’s 50 million people to smoke two.

Data obtained by reporters showing cigarette seizures did not name the companies involved, but reporters were able to trace the path of the 96 million cigarettes from CNTC’s Marshal, Golden, and Brass brands into the hands of smugglers in Colombia.

The cigarettes had been manufactured in China, and shipped to Colón, according to a senior Colombian customs official, who requested anonymity as he was not authorized to speak to journalists. They then wound their way through the Caribbean, with stops in Jamaica and Aruba –– a tactic to obscure their origin –– before finally arriving in Colombia’s coastal city of Cartagena. From there, they were transported to a free trade zone in the capital, Bogotá, he said.

While it was Colombia’s largest-ever bust of Chinese cigarettes — or any cigarettes, for that matter — it was only one of many. Cuestión Pública obtained a database of cigarette seizures compiled by Colombia’s Tax and Customs Police, which shows that six of the 10 most confiscated brands in the country between 2015 and August 2020 were produced by China Tobacco.

And the smuggling seems to be growing rapidly. Colombian authorities seized 300,000 packs of Chinese cigarettes in 2016. But more than 6 million packs were confiscated within the first seven months of 2020 alone.

Other Latin American countries show a similar pattern.

In Brazil, seizures of Chinese cigarettes increased by almost 165 percent last year, according to data OCCRP obtained through a Freedom of Information request. There were 201,386 packs confiscated in 2020, up from 76,122 the previous year. In 2015, authorities seized only 2,007 packs.

Of the 7.2 billion illegal cigarettes consumed in Mexico between February 2019 and 2020, around 38 percent were Chinese, according to Oxford Economics, a global forecasting and analysis organization. Mexican authorities seized more than 25 million packs of smuggled cigarettes in a single bust last September, including Chinese brands, according to media reports. In November, a gasoline truck owned by Mexico’s state oil company, PEMEX, was stopped on a bridge connecting Texas to the Mexican town of Reynosa with 8,500 packs of CNTC’s Marble brand stashed in the cab.

About one quarter of the illicit cigarettes consumed in Ecuador are Chinese, according to a study published this year by researchers at the Pontificia Universidad Católica del Ecuador.

“On the illicit sale of Chinese cigarettes in the region, we have no relevant knowledge,” said the Chinese embassy in Ecuador, which received a large shipment of smokes from one of the Panamanian firms in the network discovered by reporters.

In Venezuela, the consumption of illegal cigarettes has grown by 300 percent since 2019, according to a study by the BAT subsidiary Cigarrera Bigott. Illicit cigarettes comprise 30 percent of the entire market, costing the government $130 million in lost taxes annually. One CNTC brand, Golden Deer, accounts for 8 percent of the illegal market.

Experts say that Panama –– where authorities last year seized 28 containers containing illegal cigarettes before they were shipped onwards –– is the most important regional hub for this illicit trade.

"The big distribution point for Chinese, Uruguayan and Paraguayan cigarettes is Panama,” said Rico, mentioning two countries also notorious for producing illicit smokes. “All of this arrives in the Colón Free Zone, and it is then distributed throughout Latin America.”

Loose regulations and lax enforcement mean that companies can abuse the rules of the zone with few repercussions, according to Maria Lorena Cummings of the Colón Chamber of Commerce.

Any company within the zone can buy Chinese cigarettes tax free, and they can play the system in order to pay almost no duty to export them. It’s easy to make a false export declaration, especially since very few containers leaving the port are checked.

Even if a company does get caught, Cummings said the penalties are laughably low compared to the potential payoff from a shipment of smuggled cigarettes.

"It's such a profitable business that you can take the risk," she said. "If you don't have the technical staff, if you don’t have the technology… and exemplary fines, you have a breeding ground” for illegal activity.

Corporate Smokescreen

For many people, cigarette smuggling may conjure up images of rickety vessels making clandestine landings to unload illicit cargo in isolated stretches of coastline. And that still happens.

Last year, Colombian authorities busted a beat-up boat off its Caribbean coast carrying more than 1.7 million packs of Chinese cigarettes. The ship had sailed from Panama, but carried no paperwork showing the tobacco could legally enter Colombia.

But the operation uncovered by reporters involving CNTC-connected companies in Panama is far more sophisticated.

Shipments are cloaked in paperwork, giving the connected companies plausible deniability of smuggling. Yet evidence collected by journalists shows that the companies are shipping vast amounts of cigarettes to countries with no legal market for them. And the companies have done business with smugglers operating in Colombia and the U.S.

Reporters found four firms operating in Panama with connections to CNTC, although the sheer volume of Chinese cigarettes being smuggled around Latin America suggests that similar networks remain undiscovered. The four Panama-registered companies were contacted for comment but none responded.

Overseas United Inc.

Overseas United, a partnership between CNTC subsidiary Hunan China Tobacco Industrial Co., Ltd. and a Singaporean firm, began producing cigarettes in 2012 out of a factory in Panama. Three years later, the facility received an official visit by Wang Weihua, China’s top diplomat in Panama, who headed its trade office in the country.

Weihua praised Hunan China Tobacco Industrial Co., Ltd., one of the biggest subsidiaries of CNTC, for starting the factory. He added that it was a sign of China’s strategy of “going out” into the world, a state doctrine that laid the groundwork for the country’s “Belt and Road” initiative to develop trade and infrastructure globally.

“I hope that the factory will continue to expand its production scale in the future and radiate Central and South America with Panama as its base,” Weihua said in an article posted to the Chinese commerce ministry website.

He noted that it had shipped cigarettes to “Mexico, Costa Rica, Nicaragua, Colombia, Chile, Peru and other Central and South American countries” –– even though none of these countries except Chile seem to have a legal market for CNTC’s products.

But Overseas United got burned after China Tobacco brands began turning up for sale on the streets of Panama itself. Just two weeks after Weihua’s visit to the factory, authorities shut down the company. Later they also cancelled its export permits. Overseas United has not been successful in convincing the Panamanian Supreme Court to reverse the decision, but that hasn’t stopped two of the company’s executives from sending Chinese cigarettes out of the country. They’re just using another company to do it.

Finta Inc.

Overseas United’s president, Chew Seng Kiang, and its director, Chew Teck Chuang, also set up the company Finta Inc., where Chew Teck Chuang serves as director. With an address in the Colón Free Trade Zone, Finta exported more than 632 metric tons of cigarettes between May 2013 and October 2018, trade records show.

Most of these were sold to Victor M. Guerra Inc Duty Free Shop, a U.S. company whose owner, Jose Francesco Guerra, a customs broker, was convicted in May 2020 of attempting to smuggle cigarettes into Mexico. He had been arrested earlier that year after police stopped a tractor-trailer with 17 million cigarettes headed from his warehouse to Mexico. It had a fake manifest written in English claiming the cargo was used clothes, toys and purses, while another document in Spanish claimed it was cotton, according to the local media outlet MyRGV. More than 422 million cigarettes were then seized in two company warehouses, including "numerous brands of cigarettes banned in Mexico,” according to court documents.

Import data from the U.S. shows that Victor M. Guerra Inc imported CNTC brands like Win, Golden Deer, and Nise, which Mexican authorities have seized in anti-smuggling operations throughout the years.

Finta had sold the company more than 599 metric tons of cigarettes, sent from Colón to Houston in 44 separate shipments. Victor M. Guerra Inc also received cigarette shipments directly from Overseas United, as well as another Finta-connected firm called Take Roll.

Kinea Internacional SA, and Take Roll Company Ltd, S.A.

Corporate registry documents show that two legal representatives of Finta were also executives with Take Roll and Kinea, which was dissolved in 2019. One is Valeska Johanna Aedo Ayala, a Chilean national. The other is Leung Kam Fat, who is from Hong Kong and holds a British passport.

Leung and Aedo also appear in the Panama Papers, a trove of documents leaked to the International Consortium of Investigative Journalists that came from the law firm Mossack Fonseca, which set up shell companies for clients around the world. One of the companies Mossack Fonseca registered in the British Virgin Islands (BVI) shares the same name as the Panamanian firm, Take Roll.

Leung is listed as president and director of Take Roll in Panama, where Aedo is director and secretary. Leung was director and sole shareholder of Take Roll in the BVI when it was set up.

Leaked emails show that the BVI Take Roll firm was set up to facilitate tobacco trading. In a March 2014 exchange, a Mossack Fonseca lawyer provided some background on the new company.

“Our client is engaged in the purchase and re-sale of Tabaco (cigarettes) and liquors through other legal entities that we have formed for him as well,” the lawyer wrote. “These goods are supplied by companies mainly located in China and are sold to clients mainly situated within Latin American countries as Peru and Belize.”

There is no legal market for CNTC cigarettes in Peru, while Belize is a well-known smuggling hub. A 2010 report from Belize’s Intellectual Property Office shows that Kinea and Take Roll registered seven CNTC brands in that country, including Silver Elephant and Far Star.

The email listed one of Take Roll’s clients as Kinea Internacional, giving its address in the Colón free zone. The lawyer also named as suppliers three of the mainland China companies that comprise CNTC: Hongta Tobacco (Group) Co Ltd, Hunan China Tobacco Industrial Co., Ltd., Hongyunhonghe Tobacco (Group) Co Ltd.

Meanwhile, export records show that Panama-registered Kinea and Take Roll both sent Chinese cigarettes out of the Colón Free Trade Zone to a number of Latin American countries, including Peru and Colombia. Kinea shipped to Bolivia, as well as to a customer based in Ciudad del Este, the second-largest city in neighboring Paraguay, and a well-known hub for smuggling contraband across the Tri-Border Area, a region that also includes Argentina and Brazil.

In 2010, Kinea sent almost $34,500 worth of cigarettes, as well as some liquor, to the Chinese Embassy in Quito, Ecuador. The shipment raises questions about why China’s mission would need such a large amount of tobacco.

“The purchase of liquor and cigarettes by the Chinese Embassy in Ecuador constitutes diplomatic material and is for the exclusive use of the Embassy," the embassy told OCCRP.

But the shipment appeared to be too large for consumption by Chinese diplomats only, according to a tobacco control expert in Ecuador.

"I'm really surprised by that answer because $30,000 is a lot, especially for diplomatic matters,” said Tatiana Villacrés, author of several reports on illicit tobacco in Ecuador. "It's an irrational answer in my opinion."

But it was Colombia where the two companies’ smuggling connections were exposed by authorities. Between 2012 and 2018, Kinea and Take Roll exported over $40 million worth of Chinese cigarettes to Colombia. Almost all of them were destined for companies based in Maicao, a city on the northeastern frontier with Venezuela that is known for smuggling.

Kinea’s main client was José Guillermo Maestre Díaz, a popular composer of Vallenato folk music from Colombia’s Caribbean coast. But in 2015, the music stopped for Maestre, when he was arrested with 14 others and charged with being part of a large-scale smuggling network. (He was jailed for a period, but the case was later transferred to another jurisdiction and still hasn't been fully adjudicated, according to his former lawyer.)

Losing Battle

One advantage CNTC appears to have over its competitors is the ability to depend on China’s diplomatic weight, which has only increased with Belt and Road investment in Latin America.

Juan Carlos Buitrago said that when he was director of the Colombian Tax and Customs Police from 2018 to 2020, tobacco companies urged him to work with Chinese authorities to stem the flow of illegal CNTC cigarettes into the country.

“It was impossible,” said Buitrago, who now heads the consulting firm Strategos BIP.

He said the Colombian government bowed to pressure from China not to include in a bilateral trade agreement heavy measures against smuggling all kinds of goods. At one point, China’s ambassador even asked him to halt an operation against a smuggling ring that involved Chinese nationals.

“The possibility of at least trying to cooperate with the Chinese authorities was frustrating, because, in practice, this [illegal] market is part of their economic and state policy,” said Buitrago.

The Ministry of Commerce denied the claim, saying there were no bilateral trade agreements between Colombia and China. “Therefore the assertion that ‘the Colombian government gave in to pressure from China’... is inaccurate.” The Chinese Embassy in Colombia did not respond to a request for comment.

Despite Colombian efforts to fight the illegal trade in Chinese cigarettes, it’s easy to find them in Bogotá –– even in areas that have previously been raided by police for stocking smuggled smokes.

A shopkeeper in San Andresitos, an area in the city center known for black market goods, offered boxes containing 2,000 cigarettes for less than $300. The cigarettes were kept in a nearby warehouse, he said. Three other shopkeepers also offered to sell a journalist Chinese cigarettes.

Out on the street, a man was selling Marshal Mint cigarettes –– produced by Hunan China Tobacco Industrial Co., Ltd. –– out of his backpack, asking $5.50 for a carton of 10 packs. Another man offered a carton for just $4.70, or 47 cents a pack. By comparison, a pack of Marlboro or Lucky Strike would cost less than $2.50 on the legal market.

About 3,000 km north, in Mexico City’s Tepito open air market, a carton containing 20 packs of smuggled Chinese cigarettes sells for $6. On the legal market, a carton of popular brands like Camel or Chesterfield costs about $33.

If China Tobacco has its way, those cigarettes may soon be marketed legally in Mexico. At least five of the Chinese companies that make up CNTC have applied to the government for permission to sell their products in the country.

That would fit the pattern that other Big Tobacco companies have pursued: allowing their brands to flood illicit markets and then lobbying to legalize them. That’s what PMI did in previous decades with Marlboro in Colombia, according to two experts, and a customs official who requested anonymity as he was not authorized to speak to journalists.

"If you want to understand what is happening now, look what happened in the ’80s, and ’90s with the Big Tobacco producers," said the customs official.

Alessia Cerantola (OCCRP), Luiz Fernando Toledo (OCCRP), and St. John "Sinjin" Barned-Smith (Houston Chronicle) contributed reporting. Daniel Salazar (OCCRP ID) and Dragana Peco (OCCRP ID) contributed research.

Correction: This story initially misstated the number of cigarettes seized in Colombia in July 2020. It was 96 million.