In 2013, hundreds of laborers from a factory run by Bos Shelf, an Azerbaijani state-owned manufacturer of offshore oil and gas infrastructure, went on strike demanding higher wages and benefits.

"Our salary is very low," Igbal Damirov, a factory worker, told Radio Azadliq, Radio Free Europe/Radio Liberty’s Azerbaijani Service. “We do not have health insurance, we are severely punished by foreigners for the most common mistake, we are fired, we are insulted.”

The State Oil Company of Azerbaijan (SOCAR), which owns Bos Shelf LLC, promised to investigate. But in 2017, the workers made a public appeal to President Ilham Aliyev to intervene, claiming that Bos Shelf was misappropriating their pay. They singled out its general director, Ikhtiyar Akhundov, alleging he stole “millions every month” and employed his family on inflated salaries.

“There is nepotism, landlordism, and gangsterism at the plant,” the workers said in a statement. “Workers who protest against this injustice are fired.”

Throughout those years Bos Shelf was a lead contractor on a multi-billion-dollar expansion of U.K. oil giant BP’s operations in Azerbaijan’s Caspian Sea. Named Shah Deniz 2, after the vast offshore field it draws from, the development is today pumping gas thousands of kilometers west to the European Union through the Southern Gas Corridor.

But as its workers were complaining they could barely make ends meet, Bos Shelf was cashing in. Documents from inside BP, analyzed by OCCRP, show that the company and another SOCAR subsidiary together stood to siphon off more than $1.7 billion from the Shah Deniz 2 project using padded contracts and artificial charges.

Much of the money was set to be paid before any profits went to Azerbaijan’s state budget, meaning that it was not BP but the public that would lose out. At around the same time, Bos Shelf’s director, Akhundov, and his wife started buying lavish beachside properties in and around the U.S. city of Miami, an OCCRP investigation found.

BP executives were repeatedly alerted to accusations of corruption, but took no action, according to three people who worked on Shah Deniz 2. A whistleblower reported BP to the U.K.’s Serious Fraud Office in 2014, but the agency said it had not received enough evidence to open an investigation.

“We stand ready to investigate and prosecute wherever we find clear evidence of serious fraud and corruption,” the office told OCCRP.

A BP spokesperson said the oil giant carried out due diligence on its partners according to its “internal policies and procedures, which reflect both local and international legal requirements,” along with audits to ensure that “payments to entities appropriately reflect the contractual terms for the relevant goods or services provided.”

He did not directly comment on the allegations of embezzlement by the SOCAR companies, saying only that these questions “are best addressed to those entities.”

SOCAR said it and its subsidiaries abide by Azerbaijani and international anti-corruption laws, and it is regularly audited by state authorities while also carrying out internal due diligence procedures. A spokesperson said it has a strict code of conduct that all employees must follow, “reflecting the principle of zero tolerance to all forms of corruption.”

Bos Shelf, the company said, had also been regularly audited by its partners, none of which “resulted in significant adverse findings.” In a statement, SOCAR disputed that the protests were related to corruption, saying workers had wanted their salaries to be calculated in U.S. dollars rather than the local currency, which was swiftly remedied.

“Azerbaijan is being used as an EU alternative to Russian gas, but this comes at the expense of the country’s ecology and its citizens.”

Patrick Bond, expert in development economics

OCCRP’s investigation found that hundreds of millions of dollars were siphoned off from the Shah Deniz 2 project in 2014 and 2015, at a time when Azerbaijan’s government was clamping down on civil society and independent journalism. In a September 2015 resolution, the European Parliament said the country had “suffered the greatest decline in democratic governance in all of Eurasia over the past 10 years.”

"Big Oil, particularly companies like BP, are dominant and direct partners to many of the world's most authoritarian regimes," said Patrick Bond, author of the Politics of Climate Justice and a specialist in development economics at the University of Johannesburg.

"These regimes could not exist without BP as their ‘investor’ and the revenue from resources like oil and gas are used to militarise and crush public resistance."

Astronomical Bills

Publicly, BP has hailed Shah Deniz 2 as a major success, delivered on time and on budget, despite being built during a period of plummeting oil prices. The $33-billion Southern Gas Corridor that it feeds — one of the largest energy infrastructure projects in the world — is today a cornerstone of the EU’s attempts to diversify away from Russian gas and has won praise from U.S. politicians.

But emails, presentations, and letters from inside the early stages of Shah Deniz 2 show that behind the scenes, some BP officials were questioning unjustifiably high costs and inexplicable extra charges from the consortium that was building it. This included the two SOCAR-owned companies, Bos Shelf and Star Gulf FZCO, and a subsidiary of oil services company Saipem.

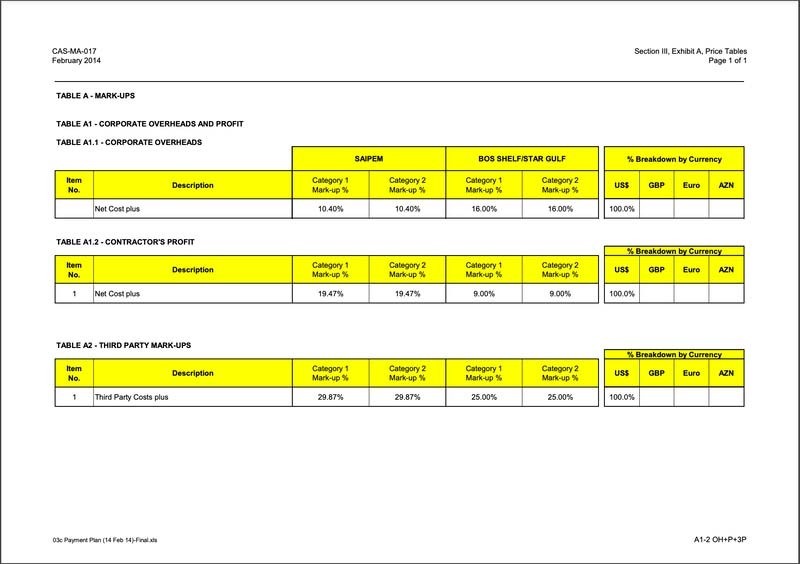

The charges were particularly problematic because BP had agreed to an unusual contracting setup with Bos Shelf and Star Gulf. A Master Agreement for one of the consortium’s largest contracts shows the companies were both guaranteed a 25 percent markup on all costs incurred during the building. Of that, nine percent was allocated as profit and the remaining 16 percent was classified as “corporate overhead.”

Normally, this category covers back-office costs like IT, administration, and office supplies — fixed expenses that should not depend much on the overall cost of the project. But, under the terms of BP’s agreement with the two SOCAR-owned companies, their profits and overhead charges automatically rose even when entirely unrelated costs increased.

Budget data from BP shows Bos Shelf and Star Gulf had already charged over $500 million in markup by mid-2015. Extrapolating from the data, this indicates that over the course of the Shah Deniz 2 project, which ran from 2014-2021, the companies would charge more than $1.7 billion in corporate overhead and profit across three contracts.

According to the ratios in the Master Agreement, more than $1.1 billion of this would be classified as corporate overhead. However, BP’s budget included $400 million for back-office costs that duplicated much of what Star Gulf and Bos Shelf were meant to provide.

“These contracts are rife with vague rules of thumb unrelated to actual costs or competitive benchmarks — like the 25 percent of net fixed costs arbitrarily allocated to Azeri elite-owned companies for ‘corporate overhead’ and ‘profit,’” said James Henry, a financial investigator and former chief economist at the U.S. management consulting firm McKinsey.

“They might as well call it ‘interior decorating,’” said Henry referring to the embellished financials, “because that is what it is.”

Other details in the BP documents raise questions about where the money paid to Star Gulf and Bos Shelf ended up. Records spanning several months show they tended to charge for the same line items, on the same days, in the same currencies. Invoices show the money flowed out of Azerbaijan in dollars to Star Gulf’s account in Dubai and Bos Shelf’s account in Luxembourg.

Star Gulf charged at a rate of between 35 and 50 percent of its sister company, the records show. But while Bos Shelf was apparently responsible for building the project’s vast subsea production systems, Star Gulf had no employees, listed no work-related expenditures, and its role in the construction is unclear. Because Star Gulf owned half of Bos Shelf, it got paid twice.

OCCRP could find little information on Star Gulf, which is registered in the United Arab Emirates. Henry described the country as “one of the top 10 most secretive financial havens in the world.”

Saipem’s Suspect History

Much of the SOCAR companies’ expenditures and markup were due to be funded from the first flows of gas from Shah Deniz 2, before any of the profits made it to Azerbaijan's state budget, the documents show. This effectively meant they would be paid out of the public purse.

SOCAR denied its companies were corrupt but declined to comment further, saying it cannot disclose financial details because it takes its “contractual confidentiality obligations to our partners seriously.”

BP budget spreadsheets show how the consortium inflated corporate overhead costs. It charged close to $79,000 a month for office food supplies, photocopying, and printing; $4.66 million for fridges, coffee machines, and coffee; and $932,000 to buy four cars for its management team. Often, expenses were duplicated in other budget lines.

At times, the costs were almost literally astronomical. In a presentation from August 2014 analyzing charges from the consortium, a BP official calculated it would charge around $150 million in rent for worksite facilities over the course of the 41-month project, equivalent to $45 million per year.

“This is just 2.5 times less [than] what Russia pays to Kazakhstan for [the] Baykonur Cosmodrome (90x85km) including hundreds of km of railways and roads, 15 rocket launchpads, 2 airdromes, rocket workshops, personnel living quarters and offices etc,” said one slide.

But the most contentious subject, it seems, was labor costs. As early as February 2014, internal BP data estimated that Bos Shelf’s figures for the man-hours needed to build the subsea infrastructure were overpriced by $15 million to $25 million.

In another presentation from January 2015, one official estimated that BP’s partners had overcharged for 84,000 man hours in 11 weeks. A report indicates that the consortium charged for the equivalent of around 400 employees that month, based on a 10-hour working day, though other data show only 144 people were employed at the time.

The issue appears to have come to a head when BP rejected a request from the consortium for 30,000 extra hours, citing poor productivity. Exchanges became increasingly heated as BP demanded more information on how labor costs were being calculated.

“Instead of working with CONTRACTOR to find a mutually acceptable outcome to the current impasse … COMPANY appears content to continually redefine the nature of the deliverable,” the consortium’s representative wrote in one letter.

Asked about the cost overruns, a Bos Shelf manager brushed it off as “a case of under-reporting, rather than over-booking,” adding acidly: “[This deep water infrastructure work] is our ‘bread and butter’, so I … ask that you be patient and allow us to do our job.”

But, asked the BP official in the January 2015 presentation, “If this is BOS’s ‘bread and butter’, how could they go so wrong with estimating??”

By April 2015, BP executives had put together a plan to negotiate with the consortium on how to cut costs. Even then, however, it was clear they knew they had to play a political game to keep SOCAR onside.

While the consortium had “limited experience,” they “potentially have more influence over SOCAR than BP,” the confidential plan read. “Due to the somewhat compromised nature of the balance of power, this negotiation should be approached in a collaborative way.”

A BP spokesperson said it had conducted due diligence on its contracts with the SOCAR-owned companies and had its own audit procedures to ensure costs are justified, but declined to comment on the commercial details of the contracts.

Turning a Blind Eye

Concerns about embezzlement in Shah Deniz 2 weren’t just raised by BP employees. In 2018, Khuraman Abil, the former head of Bos Shelf’s administrative team, filed a case in a district court in southern Baku alleging that the company had withheld $214,000 of her salary and that she had been unfairly dismissed when she complained about corruption.

The court ruled against Abil, who had worked for Bos Shelf for 16 years before being fired, saying her case was unfounded and her claim for damages came too late. She appealed all the way through Azerbaijan’s notoriously corrupt judicial system to the Supreme Court, which dismissed the case.

But a spreadsheet of people’s salaries — which Abil said was accidentally sent to her while she was working for Bos Shelf and which contains data also found in the BP files — indicates that the company did indeed keep most of her paycheck.

It shows that BP paid Bos Shelf just under $3,300 per month for her salary. In court documents, however, Abil says she received only $1,100, which Bos Shelf converted to 803 manats (around $470) using a punitive exchange rate. Payslips confirm she received significantly less than BP was paying Bos Shelf.

Abil said Akhundov, the company’s director, withheld pay and holiday from many of Bos Shelf’s workers while employing his family on inflated salaries. At the same time, she and another former Bos Shelf worker said the company inflated the price of goods and services it charged BP, including repainting old machinery and invoicing for it as if it were new.

“Let’s say if something costs one manat; they make fake documents which say the same good or service costs 100 manats,” Abil told OCCRP.

“How has BP worked [in Azerbaijan] for 30 years? A sane company wouldn’t come here.”

A former worker at the Deep Water Jacket Factory, Arif Javadov, said he also witnessed people in Bos Shelf invoicing for nonexistent goods, such as crane parts, then stealing the profits.

Javadov said that in 2013, the company’s director, Akhundov, received a letter from an anonymous sender about goods being stolen. Akhundov discovered several caches of items worth some $2 million, but did nothing, Javadov said. Soon after, the director fired several suspected whistleblowers, including Javadov.

“Ikhtiyar Akhundov ... inspected five warehouses and loaded the goods into the main warehouse. He did not return the goods,” Javadov told OCCRP. “During the three months of transporting the goods, no one was punished. Law enforcement agencies did not come.”

“In Stalin's time, people were shot for such sabotage,” he said.

SOCAR disputed Javadov and Abil’s allegations, saying that both were let go due to normal staffing changes. A spokesperson added that in both cases their managers had deemed their conduct and performance unsatisfactory.

“Several instances, including Court of Appeal and Supreme Court confirmed that the claims, raised by Khuraman Abil, were unfounded,” the spokesperson said in a statement.

Akhundov did not respond to requests for comment.

Javadov and Abil said they wrote multiple letters to Azerbaijan government agencies and officials complaining about corruption, including President Aliyev’s office and SOCAR, as well as BP. Both said BP had promised to investigate their allegations, then took no action.

In one email from 2017, responding to a complaint Abil sent to BP’s CEO, Robert Dudley, a senior official from the oil company said her pay issues were “matters for resolution between employer and employee” and dismissed her allegations of corruption.

“I would like to confirm that our investigation has not revealed any instances when BP assets would have been used by BOS Shelf to pay bribes,” wrote Gary Jones, BP’s Regional President for Azerbaijan, Georgia, and Turkey.

After raising the problems in Bos Shelf with BP dozens of times over three years, Abil said she believed the British oil company knew what was going on.

“BP itself turns a blind eye to this. These games are played in conjunction with BP,” she said.

A spokesperson for BP did not respond to questions about Abil and Javadov’s complaints, saying only that it fulfilled its due diligence obligations and any corruption allegations should be addressed to its partners.

‘They Worked Like Animals’

It wasn’t just Bos Shelf and Star Gulf that inflated costs at Shah Deniz 2. There were also the subcontractors, on whose contracts the two SOCAR-owned companies also charged a 25 percent markup.

As on any major oil and gas project, the consortium employed various smaller companies to provide specialized equipment or carry out particular work. But OCCRP’s investigation raises questions about several of these companies — and where the money they were paid ended up.

One was Caspian Business Services (CBS), run by Akhundov’s brother-in-law, Rauf Habibly. Until 2012 he had been the mayor of Quba, a city in northern Azerbaijan, but he was dismissed in disgrace after scathing remarks he made about local people sparked violent riots that ended with 25 facing criminal charges.

Abil said CBS grew rapidly after 2013, when the company was tasked with renovating an office building for the Shah Deniz 2 project. She said CBS cut costs by employing desperate itinerant workers to do the heavy labor demolishing the inside of the offices and building workshops outside.

“I saw it with my own eyes,” she said. “They worked like animals and were paid little ... A worker from the countryside comes to Baku, works 17 hours a day and earns 16 manats.”

Abil said CBS never participated in a tender to work on Shah Deniz 2, and OCCRP could find no evidence in the BP documents that it had done so. Nonetheless, records show that Bos Shelf hired the company to work on parts of the terminal’s new marine base, and to construct buildings and infrastructure.

Emails show BP employees questioning audits of the company’s bids, including one asking for AZN60,000 ($76,500) to build an unnecessary block of toilets and another that “grossly” inflated the cost of a new workshop, parts of it by more than 50 percent. One BP letter highlights the lack of detail in a CBS proposal to build concrete supports, including no information on the materials and man-hours required, or how payments would be made.

Nonetheless, BP approved the contract.

A BP spokesman declined to comment on questions about Shah Deniz 2 subcontractors without access to the leaked documents, saying only that “these queries should also be directed to the relevant counterparties.” CBS did not respond to a request for comment, and OCCRP could not reach Habibly personally.

CBS wasn’t the only subcontractor to overcharge. Invoices show one company contracted by Bos Shelf to kill stray dogs near the development charged 460 manats ($270) per animal, which was around the same as a month’s salary for a factory worker at the time.

CBS was among the consortium’s “incumbent” or “single source” suppliers, subcontractors which had long-term relationships with the SOCAR-owned companies that were managed largely independently from BP. On paper, BP was meant to keep tabs on the smaller suppliers and vet any company awarded a contract over $250,000 without a competitive bid. But an internal BP assessment described Bos Shelf’s reporting process as “an extremely poor procedure which gives us no control whatsoever.”

Anti-money laundering expert Eryn Schornick said single-source or ‘limited tendering’ contracting processes “are a major departure from fundamental principles of transparency and competition.”

“When combined with a pre-existing relationship between the contractors and subcontractors, it raises potential red flags for corruption like bribes or kickbacks and favoritism,” she said.

In some cases, OCCRP’s investigation found that subcontractors involved in Shah Deniz 2 appear to be shell companies that raised red flags for money laundering.

Money Laundering Risks

One contractor brought in by the consortium was flagged by a senior BP employee as a money laundering risk. OCCRP’s reporting shows it had ties to other subcontractors that raise even more questions.

“This complex web of opaque corporate structures, associated companies, and personal and professional relationships reaching into offshore tax havens far removed from Azerbaijan, raise serious questions of corruption,” said Schornick.

“What’s more is that the apparent lack of information on the real life people who own or control these companies may be a way in which shell companies were used to disguise kickback schemes or hide and launder proceeds of corruption.”

Lavish Properties

Around the time when Bos Shelf was overcharging for work on Shah Deniz 2, its director, Akhundov, was going on a property spending spree.

In June 2015 — the same year Akhundov was named man of the year by SOCAR-backed Oil & Gas Year magazine — he and his wife, Balajakhanim Ismayilova, bought a $3 million apartment in Miami in a luxurious beachfront complex named The Setai Residences.

Two years later, while real estate outlets were reporting that the block contained some of the most expensive pads in Miami Beach, Akhundov bought another for $5.5 million. Property records show no mortgage was taken out to purchase either apartment, indicating they were bought in cash.

A search of Florida property records reveals Ismayilova is the owner of another five-bedroom property a little further north, in Fort Lauderdale, which she bought for $2 million in 2017. Akhundov is also listed as the former manager of a Florida-registered company that owns two commercial properties in San Francisco.

Pictures posted on social media show Ismayilova living the high life, including holidays in the Seychelles, along with trips to Tulum in Mexico, Havana in Cuba, and Paris, France. One photo from November 2016 shows her, Akhundov, and their daughter out for dinner in the Ritz London with Dominique Roussat, senior commercial manager at Bos Shelf, and his family.

It’s unclear how Akhundov’s family accumulated so much wealth. His salary is not included in the BP documents, though they show other senior executives at Bos Shelf earned around $470,000 to $500,000 a year.

Akhundov’s wife, Ismayilova, is a lawyer, who spent two decades working for the UN High Commissioner for Refugees. In 2018, she co-founded Crystal Law Firm with her mother, the former head of the Legal Department of Azerbaijan’s Cabinet of Ministers, Hagigat Ismayilova.

Neighbors of Crystal Law’s listed address — an apartment in a residential building — told a reporter they had never seen anyone visiting. Several people said Akhundov owned the apartment and used to live there, though as Azerbaijan has no public property database OCCRP could not confirm this.

Akhundov, Ismayilova, and Crystal Law Firm did not respond to requests for comment. SOCAR did not respond to questions about Akhundov’s salary and spending.

The Shah Deniz 2 expansion is completed and Bos Shelf is now reportedly working on developing Azerbaijan’s Absheron oil and gas field with France’s Total. Star Gulf, meanwhile, has quietly disappeared.

In 2019, it stopped being listed in SOCAR’s accounts and was replaced by another company registered in the UAE named Bos Shelf International FZCO. The single corporate document OCCRP could find for Bos Shelf International shows it is fully owned by Ilham Nuriyev.

Someone with the same name started working for Bos Shelf in 2020 as an onshore site representative in Baku. When OCCRP reached out for comment via Linkedin, he responded that he “was not interested” in answering any questions.

Kelly Bloss (OCCRP) contributed reporting.