Bulgartabak Holding, in the year since Bulgaria joined the European Union, lost a third of its near monopoly over cigarette sales to foreign competitors.

It is likely to lose more.

Unlike Bulgartabak, foreign firms are efficient and flexible, able to buy only as much tobacco as they need from sellers offering them the best price. In contrast, Bulgartabak remains tightly controlled by the Movement for Rights and Freedoms (DPS), the political party of the Turkish minority and part of the ruling coalition. Counted among the party powerful are major tobacco producers who can pressure the government firm to buy more of their product.

Where a private factory can produce 30,000 tons of cigarettes with 800 to 1,000 workers, Bulgartabak uses 2,000 DPS-loyal workers in four factories.

On top of that, Bulgarians overall are smoking less. Research shows a decline in consumption from more than 20 billion cigarettes in 2005 to 18 billion in 2006. EU rules call for strict regulation of harm to the public health from tobacco.

Privatization would seem a logical way to protect one of the country’s most lucrative assets. Bulgartabak, a joint stock company, has 22 subsidiaries countrywide, including 12 tobacco-processing factories, nine cigarette plants and one that produces tobacco dryers, filters and packing. It has three factories in Russia, one in the Ukraine and is planning a new one in Slovakia as part of a joint venture.

The party, however, has thwarted attempts to privatize some or all of this over the past decade.

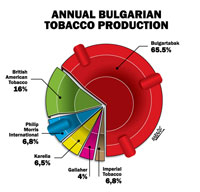

Now EU entry has made the disparities between the state firm and its competitors costly. In 2006, Bulgartabak held 95 percent of the market; today it has 71 percent.

A rich opportunity

“Our market share has reached 6.8 percent since the return of Philip Morris International to the Bulgarian market a year ago,” Andrey Vassilescu, regional manager for Bulgaria, said this summer.

“Although Bulgaria is a small country, it has great potential for growth,” said Richard Morgan, the managing director for Bulgaria and Romania. Philip Morris managers view Bulgartabak as their chief competitor and do not deny they be interested if privatization happened.

British American Tobacco, Karelia, Gallaher and Imperial Tobacco also have entered Bulgaria with strong brands, massive ad and marketing campaigns – and cheap cigarettes.

While Bulgarian law forbids advertising of cigarettes outside of stores where they are sold, brand names can be promoted, so the country has filled with billboards and store signs that reflect the intense contest for smokers’ attention. click to enlarge

click to enlarge

Bulgartabak has tried to hold off the new competition over the past year with hefty price cuts. It has dropped the price of 21 brands by as much as 15 percent. The strategy may not work for much longer. As Morgan explained, Bulgaria must, by 2010 nearly double excise taxes to bring them in line with EU levels.

One other effect of joining the EU has been the end to fixed pricing of tobacco by the Ministry of Finances. Producers no longer need permission from the ministry to sell cigarettes and are free to price them as they like. This has resulted in a drop in prices for all cigarettes, especially brands in the middle price range, as all companies vie for customers. New, very cheap foreign cigarettes are most threatening to sales of Bulgartabak’s best-sellers, Victory and Eva for women brands, the prices of which have not been reduced.

To fight back Bulgartabak instead launched an ad campaign touting those brands and changed distribution tactics, signing contracts with nine big traders by giving them exclusive right to see its products in set regions of the country. The traders were ordered not to compete with each other and not to sell the products of any Bulgartabak competitors. In return, they were given bigger commissions of up to 6 percent, the same foreign companies offered.

The competition continues with the foreign tobacco companies offering popular new brands at low prices.

BAT’s Bulgarian strategy

BAT executives opened a Bulgarian office in 1992 and now employ more than 200 people and operated an extensive distribution network that sells low-cost Viceroys, Pall Malls and Kents and Vogues. They say they are surprised at the pace of sales and they plan to increase production in their Romanian factories to accommodate it. Plans also are underway, according to John Gillen general manager of BAT-Bulgaria, to build production capacity in Poland and Germany.

The firm bought excise labels for 80 tons – a ton is 50,000 packages – of Viceroy and Pall Malls.

Bulgartabak privatization

Government officials at first blocked privatization of Bulgartabac, blaming the time-consuming process of passing enabling legislation. Then in April, DPS unexpectedly changed position, saying it was important to help factory workers keep jobs. They then devised an odd strategy to sell off the firm.

The state holding in each Bulgartabak factory was divided into two packages, one a controlling share to be sold to investors and a second package of single shares to be sold to individuals. The Blagoevgrad and Sofia factories were bundled together. In a separate privatization procedure, a new owner will be sought for a tobacco cultivation plant in Pleven.

The recently privatized South Korean tobacco monopoly has shown interest, according to sources close to the dealing for Bulgartobac, as has an investment fund with western capital which has been buying property mostly in Russia. Michael Chorney, a Russian-Israel businessman who has tried unsuccessfully in the past to buy Bulgartabac, is also interested, according to sources.

Last year, BAT wanted to buy the biggest of Bulgartabak’s factories in Sofia and Blagoevgrad, a move the government blocked.

In late 2006, in contrast, the government did allow the sale of the Yuri Gargarin packaging plant in Plovdiv to Baranko Ltd, a firm registered in Cyprus and represented by the manager of the plant and his brother.

Over the past year, the value of Bulgartabak plants has dropped. In April the firm halved the valuation of its Yambol factory from the 1.4 million leva it had claimed last February. The asking price for its Dupnica plant fell in March from 204,000 leva to 10,000. The minimum price for Smolian factory is 1.5 million leva and for Kardjaly, 2.5 million.

More than 78 percent of the Goce Delchev plant was offered on the Stock Exchange for just 2.25 million leva.

Still in good shape

Bulgartaback finances have not yet begun to show the full extent of the new competition.

Thanks to a sale of assets, including the Yuri Gagarin packaging plant in Plovdiv, profits continue. Records for the first nine months of 2007 show a profit of 11.6 million leva.

Bulgartabac chief Hristo Lachev has proposed shutting all but one of the firm’s two biggest plants, Sofia or Blagoevgrad, but officials have not to date responded to that plan.

Unsmoking for Health

A campaign to get doctors to recommend IQOS, a hidden medical report, and a brigade of industry-backed scientists: Inside...