Serbia’s new weapon against OC

A man serving 40 years in prison for his role in the assassination of the Serbian prime minister now stands to lose his Belgrade villa, his Athens apartment and bank accounts in Switzerland and Greece under a new law on asset forfeiture passed in Serbia in March.

The heavily tattooed former French Foreign Legionnaire Milorad Ulemek was in a Belgrade court last week, where the fate of his bank accounts and property will be decided. He had been affiliated with the Zemun Clan, a notorious Serbian crime group that specialized in kidnapping, in smuggling of arms, cigarettes and people and in murders, including the assassination of Prime Minister Zoran Djindjic in 2003.

The state prosecutor said this month that the assets of other criminal Zemun Clan members also have been temporarily confiscated and may be permanently seized under the new law.

The law, which came into effect March 1, freezes assets whose value is found to be out of line with a suspect’s legal income. It allows the state to confiscate the assets if the suspect is convicted of organized crime, child pornography, human trafficking, narcotics trafficking, corruption and crimes against humanity. The suspect has to prove the property was acquired legally.

"I think that the government has shown absolute readiness; now it is up to the prosecution and courts to allow for the adequate implementation of the law,” Justice Ministry state secretary Slobodan Homen said earlier about Serbia’s new asset forfeiture program, which authorities there are trumpeting as a powerful tool to fight Serbia’s entrenched organized crime groups.

Taking Proceeds of Racketeering

Serbia is the latest country to target organized crime by passing laws to allow the state to take the proceeds of drug dealing, racketeering and other malfeasance. The 27-nation European Union (EU) is also looking to create national offices to coordinate forfeiture across borders. Countries like the US, Britain, and even Colombia have used asset forfeiture to the detriment of organized crime, and a recent study suggests that anti-organized crime programs that ignore asset forfeiture fail to use an important weapon. But an attorney with one watchdog group warns that forfeiture, if unsupervised, may contribute to crime and corruption.

Serbia is the latest country to target organized crime by passing laws to allow the state to take the proceeds of drug dealing, racketeering and other malfeasance. The 27-nation European Union (EU) is also looking to create national offices to coordinate forfeiture across borders. Countries like the US, Britain, and even Colombia have used asset forfeiture to the detriment of organized crime, and a recent study suggests that anti-organized crime programs that ignore asset forfeiture fail to use an important weapon. But an attorney with one watchdog group warns that forfeiture, if unsupervised, may contribute to crime and corruption.

Asset forfeiture is as old as money. The Bible’s book of Exodus advises that if an ox gores someone to death, the ox should be stoned rather than the errant ox’s owner. In medieval England, according to crime scholar Cecil Greek, convicted thieves forfeited their stolen goods to the king. This is similar to modern-day criminal forfeiture, in which someone convicted of a crime can see his ill-gotten gains turned over to the state. Colonial American smugglers who violated the Crown’s customs laws were either charged themselves, or saw their ships and/or the cargo charged. This old-school method of charging illicit cargo is similar to today’s in rem (Latin for “regarding a thing”) cases, in which an item or money itself is considered criminal, and seized without anyone being convicted of a crime. For a crime like smuggling, in rem actions made sense because it was often easier for the authorities to catch the illicit cargo than it was to catch the smuggler himself.

More than two centuries later in the United States, what became new was the idea that these laws could apply to drug dealers and other organized criminals.

“What changed in 1982 was that we applied rudimentary forfeiture to racketeering,” said Cameron Holmes, senior litigation counsel in the southwestern state of Arizona’s Attorney General’s office. Holmes drafted the 1982 statute that applied forfeiture in rem. “Let’s say an airplane is found at a remote landing strip in southern Utah,” he said. “It’s crashed and was used to haul drugs – it’s subject to forfeiture without catching the people.”

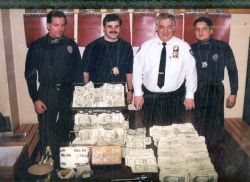

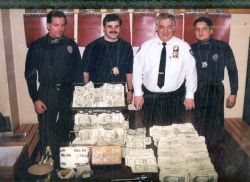

The federal government followed suit, with the Comprehensive Crime Control Act of 1984 passed when the Ronald Reagan-era war on drugs was hitting its stride. Besides establishing two new federal forfeiture funds (one at the Department of Justice and another at the US Treasury), the act had a provision for “equitable sharing,” which allows local police to have part of the procefeds of forfeitures they help make under federal law. (Before, all seized assets were simply handed over to the federal government.) The money has poured in. Deposits into the Department of Justice fund were $27 million in 1985; last year net deposits totaled $1.3 billion.

Taking Incentive Out of Crime

Holmes said asset forfeiture, by grabbing the money, houses, boats, planes and jewelry, takes the incentive out of crime.

“It’s a business,” Holmes said of the drugs trade and other illegal schemes. “The most powerful single thing that you could deprive a business of is capital. So if you can take the capital formation out of the business plan, the business is crippled and withers and dies.”

Holmes noted that transport is an essential part of business for crooks trafficking people from the US to Mexico. These so-called coyotes were overpaying about 15 percent for used cars from lots in Phoenix; in return the dealership would claim the vehicles were bought on credit, thus keeping the cash and keeping a lien, or hold, on the vehicle, so that if the vehicle was caught in the act, the government would have to return it to the dealership. After an undercover investigation, the Attorney General’s office seized 11 of these lots. One of the lot owners, after figuring out how to work with the coyotes, had seen his monthly gross sales go from $20,000 to $400,000.

“They’re not coyotes but they’re facilitating coyotes and they’re making out really well,” Holmes said of the lot owners. But with the risk of seizure, “at some point that small businessman says, ‘Hey, the risk of loss outweighs the likelihood of gain.’ ”

Seizing assets has become a key part of fighting organized crime, according to a recent study. Edgardo Buscaglia, a senior law and economics scholar at Columbia University, found that countries that have been able to disrupt organized crime have had to simultaneously 1) go after the top hierarchy of organized crime, 2) go after political corruption, 3) establish asset forfeiture programs and 4) prevent money laundering by educating banks and financial police.

“Countries think that by just going after the capos, organized crime will be controlled. But you need to have four wheels on the car, otherwise it’s impossible to see results,” Buscaglia said.

Research Shows Success

In “The Paradox of Expected Punishment,” published last October, Buscaglia also found that a 10 percent increase in the forfeiture of criminal assets is associated with a nearly 8 percent decrease in the levels of organized crime.

Mexico, he noted, doesn’t have a specific forfeiture program. Meanwhile, the news from Mexico’s cartels-versus-the-military drug war has been grim, with 6,000 people killed in drug violence last year alone. “They have a new law they’re planning to pass in the next few weeks, but they don’t have the financial intelligence, they don’t have special units in the police trained, they don’t have the political will,” he said.

The law, which would allow the government to seize property from suspected drug traffickers and other criminals before they are convicted, passed Mexico’s upper house earlier this month and will now go to the lower house. If the Mexican law passes, Mexico will join various other countries around the world with asset forfeiture programs. Ireland, following the murder of journalist Veronica Guerin who was investigating the Irish criminal underworld, passed the Criminal Assets Bureau Act in 1996. The UK’s Proceeds of Crime Act was enacted in 2002; the country has also had civil seizure since 2007, used when the property itself is considered criminal and can be seized without charging or convicting the owner.

While various European countries already have asset forfeiture programs in place, the European Commission in November proposed that each EU member country form so-called “asset recovery offices” to seize criminal proceeds and be a focal point for international requests, statistics and training. The offices would then be able to exchange intelligence with each other on who is the actual owner of criminals’ assets and where the assets are located.

The Commission also proposed that countries allow seizures without first securing criminal convictions, putting the cases in civil court and putting the burden of proof on the owner, who would have to prove that the item’s origin, or the origin of the money used to purchase it, was legitimate.

Program Can Stir Controversy

Though these are the rules by which many US states play, and are in line with recommendations from the international money-laundering watchdog the Financial Action Task Force, civil forfeiture became controversial in the US in the 1990s, because it required no conviction --the polar opposite of the innocent-until-proven-guilty foundations of the US justice system. Criminal forfeiture is not without its critics, either.

The rights of so-called “third parties” – someone whose property has been confiscated but who is not involved in the alleged crime – is the main concern of one lawyer with more than 20 years of experience defending forfeiture cases.

“The people in the worst predicament of all are third parties whose property is tied up in criminal forfeiture cases – they’re sitting there waiting for what happens in a criminal case that can take 10 years,” said Brenda Grantland, a California lawyer who has defended hundreds of cases.

She cited a recent case in which a Chicago-based hedge fund had lent more than $100 million to Petters Group Worldwide (PGW), a collection of some 20 companies, including Polaroid. PGW owner Tom Petters, however, is now on trial for allegedly operating a $3.5 billion Ponzi scheme through another company he owns. All assets belonging to Petters, PGW and the other companies were placed into receivership; the Chicago-based hedge fund cannot recover on its defaulted secured loans against the corporations, particularly now that the receiver has put Polaroid into bankruptcy and a court has sold its assets. “The property is being liquidated prior to trial,” Grantland wrote in a follow-up email.

‘But Grantland also had serious concerns about forfeiture programs that have shown to be a source of crime and corruption themselves, rather than a method to end those ills, particularly because the forfeiture programs help fund cash-strapped police departments.

Grantland pointed to a New Mexico case in which police had searched a house looking for a fleeing domestic violence suspect, and seized $10,000 from the suspect’s roommate. Because the roommate took the city of Albuquerque to court to get his money back, the authorities audited the seizure program and discovered that assets were being seized without anyone filing forfeiture actions. The property was being held by the property clerk. Cash had gone missing for nearly four years, and the paper trail had been destroyed. The full amount embezzled was never discovered, although the New Mexico attorney general’s office said available evidence indicated as much as $58,000 went missing during 2002 and 2003. Two employees in the evidence room were fired in the matter, although others had access to the evidence room and cash.

In DC: “The Cops Went Crazy”

In another case from the 1980s, Grantland said, District of Columbia police had no oversight of the forfeiture program. “The cops went crazy,” she said. “They were taking people’s cars, they were sending notices to false addresses. It was a sham. We finally went into their impound lot and it looked like a car-parts yard – vehicles were up on blocks, hoods were open with parts missing. Somebody out there was stealing the stuff from the cars; it was that type of outrageous abuse.”

“One of the things we’ve seen about it consistently is that the crooks among the police gravitate towards the forfeiture unit where they can steal,” she said. “There’ve been so many scandals about it.”

It was incidents like these that led members of the US Congress to press for the Civil Asset Forfeiture Reform Act, which became law in 2000. It did shift more of the burden of proof onto the government, as opposed to the owners having to prove their properties were not guilty, and created an “innocent owner” defense, so that property owners unaware of criminal activity on their property could recover their property. The reforms, however, didn’t end the practice of giving forfeiture proceeds back to the police, which some say is a clear conflict of interest.

And controversy lives on in state jurisdictions. A Texas newspaper reported earlier this year that police in a town of 1,000 had seized property from 140 drivers stopped for minor offenses. The take was thousands in cash, cell phones, jewelry and the cars themselves, but in two years police had filed charges in fewer than half the cases. One lawyer called the practice “highway piracy.” A state lawmakers’ committee has recommended that the burden of proof be shifted onto the state, and that the state should centralize the forfeiture fund and give the state’s comptroller the authority to audit and investigate abuses.

“The same chain of abuses is present everywhere,” Grantland said. “They pass the law, they don’t have due process, and then things have to get up to the highest courts and then they roll it back a little.”

Serbia, however, doesn’t have to reinvent the wheel; it can benefit from the years of experience with the program and implement safeguards that have been suggested. Grantland recommends that any new forfeiture program have very strong oversight: “And the public needs to be able to challenge where the proceeds go, how they’re used, and how the process is being followed.”

--Beth Kampschror

The state prosecutor said this month that the assets of other criminal Zemun Clan members also have been temporarily confiscated and may be permanently seized under the new law.

The law, which came into effect March 1, freezes assets whose value is found to be out of line with a suspect’s legal income. It allows the state to confiscate the assets if the suspect is convicted of organized crime, child pornography, human trafficking, narcotics trafficking, corruption and crimes against humanity. The suspect has to prove the property was acquired legally.

"I think that the government has shown absolute readiness; now it is up to the prosecution and courts to allow for the adequate implementation of the law,” Justice Ministry state secretary Slobodan Homen said earlier about Serbia’s new asset forfeiture program, which authorities there are trumpeting as a powerful tool to fight Serbia’s entrenched organized crime groups.

Taking Proceeds of Racketeering

Serbia is the latest country to target organized crime by passing laws to allow the state to take the proceeds of drug dealing, racketeering and other malfeasance. The 27-nation European Union (EU) is also looking to create national offices to coordinate forfeiture across borders. Countries like the US, Britain, and even Colombia have used asset forfeiture to the detriment of organized crime, and a recent study suggests that anti-organized crime programs that ignore asset forfeiture fail to use an important weapon. But an attorney with one watchdog group warns that forfeiture, if unsupervised, may contribute to crime and corruption.

Serbia is the latest country to target organized crime by passing laws to allow the state to take the proceeds of drug dealing, racketeering and other malfeasance. The 27-nation European Union (EU) is also looking to create national offices to coordinate forfeiture across borders. Countries like the US, Britain, and even Colombia have used asset forfeiture to the detriment of organized crime, and a recent study suggests that anti-organized crime programs that ignore asset forfeiture fail to use an important weapon. But an attorney with one watchdog group warns that forfeiture, if unsupervised, may contribute to crime and corruption. Asset forfeiture is as old as money. The Bible’s book of Exodus advises that if an ox gores someone to death, the ox should be stoned rather than the errant ox’s owner. In medieval England, according to crime scholar Cecil Greek, convicted thieves forfeited their stolen goods to the king. This is similar to modern-day criminal forfeiture, in which someone convicted of a crime can see his ill-gotten gains turned over to the state. Colonial American smugglers who violated the Crown’s customs laws were either charged themselves, or saw their ships and/or the cargo charged. This old-school method of charging illicit cargo is similar to today’s in rem (Latin for “regarding a thing”) cases, in which an item or money itself is considered criminal, and seized without anyone being convicted of a crime. For a crime like smuggling, in rem actions made sense because it was often easier for the authorities to catch the illicit cargo than it was to catch the smuggler himself.

More than two centuries later in the United States, what became new was the idea that these laws could apply to drug dealers and other organized criminals.

“What changed in 1982 was that we applied rudimentary forfeiture to racketeering,” said Cameron Holmes, senior litigation counsel in the southwestern state of Arizona’s Attorney General’s office. Holmes drafted the 1982 statute that applied forfeiture in rem. “Let’s say an airplane is found at a remote landing strip in southern Utah,” he said. “It’s crashed and was used to haul drugs – it’s subject to forfeiture without catching the people.”

The federal government followed suit, with the Comprehensive Crime Control Act of 1984 passed when the Ronald Reagan-era war on drugs was hitting its stride. Besides establishing two new federal forfeiture funds (one at the Department of Justice and another at the US Treasury), the act had a provision for “equitable sharing,” which allows local police to have part of the procefeds of forfeitures they help make under federal law. (Before, all seized assets were simply handed over to the federal government.) The money has poured in. Deposits into the Department of Justice fund were $27 million in 1985; last year net deposits totaled $1.3 billion.

Taking Incentive Out of Crime

Holmes said asset forfeiture, by grabbing the money, houses, boats, planes and jewelry, takes the incentive out of crime.

“It’s a business,” Holmes said of the drugs trade and other illegal schemes. “The most powerful single thing that you could deprive a business of is capital. So if you can take the capital formation out of the business plan, the business is crippled and withers and dies.”

Holmes noted that transport is an essential part of business for crooks trafficking people from the US to Mexico. These so-called coyotes were overpaying about 15 percent for used cars from lots in Phoenix; in return the dealership would claim the vehicles were bought on credit, thus keeping the cash and keeping a lien, or hold, on the vehicle, so that if the vehicle was caught in the act, the government would have to return it to the dealership. After an undercover investigation, the Attorney General’s office seized 11 of these lots. One of the lot owners, after figuring out how to work with the coyotes, had seen his monthly gross sales go from $20,000 to $400,000.

“They’re not coyotes but they’re facilitating coyotes and they’re making out really well,” Holmes said of the lot owners. But with the risk of seizure, “at some point that small businessman says, ‘Hey, the risk of loss outweighs the likelihood of gain.’ ”

Seizing assets has become a key part of fighting organized crime, according to a recent study. Edgardo Buscaglia, a senior law and economics scholar at Columbia University, found that countries that have been able to disrupt organized crime have had to simultaneously 1) go after the top hierarchy of organized crime, 2) go after political corruption, 3) establish asset forfeiture programs and 4) prevent money laundering by educating banks and financial police.

“Countries think that by just going after the capos, organized crime will be controlled. But you need to have four wheels on the car, otherwise it’s impossible to see results,” Buscaglia said.

Research Shows Success

In “The Paradox of Expected Punishment,” published last October, Buscaglia also found that a 10 percent increase in the forfeiture of criminal assets is associated with a nearly 8 percent decrease in the levels of organized crime.

Mexico, he noted, doesn’t have a specific forfeiture program. Meanwhile, the news from Mexico’s cartels-versus-the-military drug war has been grim, with 6,000 people killed in drug violence last year alone. “They have a new law they’re planning to pass in the next few weeks, but they don’t have the financial intelligence, they don’t have special units in the police trained, they don’t have the political will,” he said.

The law, which would allow the government to seize property from suspected drug traffickers and other criminals before they are convicted, passed Mexico’s upper house earlier this month and will now go to the lower house. If the Mexican law passes, Mexico will join various other countries around the world with asset forfeiture programs. Ireland, following the murder of journalist Veronica Guerin who was investigating the Irish criminal underworld, passed the Criminal Assets Bureau Act in 1996. The UK’s Proceeds of Crime Act was enacted in 2002; the country has also had civil seizure since 2007, used when the property itself is considered criminal and can be seized without charging or convicting the owner.

While various European countries already have asset forfeiture programs in place, the European Commission in November proposed that each EU member country form so-called “asset recovery offices” to seize criminal proceeds and be a focal point for international requests, statistics and training. The offices would then be able to exchange intelligence with each other on who is the actual owner of criminals’ assets and where the assets are located.

The Commission also proposed that countries allow seizures without first securing criminal convictions, putting the cases in civil court and putting the burden of proof on the owner, who would have to prove that the item’s origin, or the origin of the money used to purchase it, was legitimate.

Program Can Stir Controversy

Though these are the rules by which many US states play, and are in line with recommendations from the international money-laundering watchdog the Financial Action Task Force, civil forfeiture became controversial in the US in the 1990s, because it required no conviction --the polar opposite of the innocent-until-proven-guilty foundations of the US justice system. Criminal forfeiture is not without its critics, either.

The rights of so-called “third parties” – someone whose property has been confiscated but who is not involved in the alleged crime – is the main concern of one lawyer with more than 20 years of experience defending forfeiture cases.

“The people in the worst predicament of all are third parties whose property is tied up in criminal forfeiture cases – they’re sitting there waiting for what happens in a criminal case that can take 10 years,” said Brenda Grantland, a California lawyer who has defended hundreds of cases.

She cited a recent case in which a Chicago-based hedge fund had lent more than $100 million to Petters Group Worldwide (PGW), a collection of some 20 companies, including Polaroid. PGW owner Tom Petters, however, is now on trial for allegedly operating a $3.5 billion Ponzi scheme through another company he owns. All assets belonging to Petters, PGW and the other companies were placed into receivership; the Chicago-based hedge fund cannot recover on its defaulted secured loans against the corporations, particularly now that the receiver has put Polaroid into bankruptcy and a court has sold its assets. “The property is being liquidated prior to trial,” Grantland wrote in a follow-up email.

‘But Grantland also had serious concerns about forfeiture programs that have shown to be a source of crime and corruption themselves, rather than a method to end those ills, particularly because the forfeiture programs help fund cash-strapped police departments.

Grantland pointed to a New Mexico case in which police had searched a house looking for a fleeing domestic violence suspect, and seized $10,000 from the suspect’s roommate. Because the roommate took the city of Albuquerque to court to get his money back, the authorities audited the seizure program and discovered that assets were being seized without anyone filing forfeiture actions. The property was being held by the property clerk. Cash had gone missing for nearly four years, and the paper trail had been destroyed. The full amount embezzled was never discovered, although the New Mexico attorney general’s office said available evidence indicated as much as $58,000 went missing during 2002 and 2003. Two employees in the evidence room were fired in the matter, although others had access to the evidence room and cash.

In DC: “The Cops Went Crazy”

In another case from the 1980s, Grantland said, District of Columbia police had no oversight of the forfeiture program. “The cops went crazy,” she said. “They were taking people’s cars, they were sending notices to false addresses. It was a sham. We finally went into their impound lot and it looked like a car-parts yard – vehicles were up on blocks, hoods were open with parts missing. Somebody out there was stealing the stuff from the cars; it was that type of outrageous abuse.”

“One of the things we’ve seen about it consistently is that the crooks among the police gravitate towards the forfeiture unit where they can steal,” she said. “There’ve been so many scandals about it.”

It was incidents like these that led members of the US Congress to press for the Civil Asset Forfeiture Reform Act, which became law in 2000. It did shift more of the burden of proof onto the government, as opposed to the owners having to prove their properties were not guilty, and created an “innocent owner” defense, so that property owners unaware of criminal activity on their property could recover their property. The reforms, however, didn’t end the practice of giving forfeiture proceeds back to the police, which some say is a clear conflict of interest.

And controversy lives on in state jurisdictions. A Texas newspaper reported earlier this year that police in a town of 1,000 had seized property from 140 drivers stopped for minor offenses. The take was thousands in cash, cell phones, jewelry and the cars themselves, but in two years police had filed charges in fewer than half the cases. One lawyer called the practice “highway piracy.” A state lawmakers’ committee has recommended that the burden of proof be shifted onto the state, and that the state should centralize the forfeiture fund and give the state’s comptroller the authority to audit and investigate abuses.

“The same chain of abuses is present everywhere,” Grantland said. “They pass the law, they don’t have due process, and then things have to get up to the highest courts and then they roll it back a little.”

Serbia, however, doesn’t have to reinvent the wheel; it can benefit from the years of experience with the program and implement safeguards that have been suggested. Grantland recommends that any new forfeiture program have very strong oversight: “And the public needs to be able to challenge where the proceeds go, how they’re used, and how the process is being followed.”

--Beth Kampschror