Ever wanted to buy your own private offshore bank? Then Michael Maurice O’Mara de la Fuente has a deal for you.

The 62-year-old Cuban-Irish Dutchman, who lives in a suite in an English seaside hotel but runs his bank-brokering business out of Cyprus, can speak lyrically — and at length — of the advantages of acquiring what he describes as a ready-made offshore financial institution.

“The potential to make multi-million profits by owning and controlling your own private offshore bank is limited only by your imagination,” reads the pitch on O’Mara’s website, BuyBankNow.com.

O’Mara claims there are myriad other advantages to buying one of his off-the-shelf banks, which start at just under 25,000 British pounds: You can issue your own loans, mortgages, credit ratings, credit cards, and letters of credit, and perform “countless financial operations which are the domain of the major banks only.” Best of all, if things turn bad, you can seize your own assets before your creditors do.

And, O’Mara insists, there’s nowhere better to do these things than Gambia, the smallest country in mainland Africa and a hotbed of corruption that, for years, suffered under the iron rule of dictator Yahya Jammeh.

In fact, O’Mara’s banks aren’t banks at all.

The Gambian entities he peddles are merely misleadingly titled shell companies — or “bank-named companies,” as he has described them privately to colleagues. There is no evidence any of them have any capital, as a real bank would.

And even the shell companies masquerading as banks aren’t legally valid, since Formations House was simply entering them into its own unofficial company registry, which never had legal standing with the Gambian government.

O’Mara has created more than 150 of the fake lenders since 2013 in a Gambian offshore zone that, like his banks, exists on paper only. Today, O’Mara claims to be working on his own, but for years he was one of the most brazen — and successful — salesmen working on behalf of Formations House, a UK-based company registration firm implicated in multiple frauds and failures of due diligence over the course of its 18-year existence.

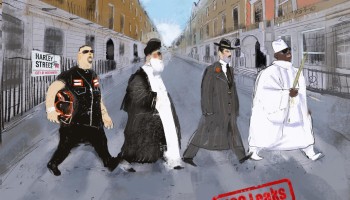

Drawing on a cache of leaked emails and other data obtained by the information activist group Distributed Denial of Secrets and shared with journalists, OCCRP pieced together the story of how Formations House and O’Mara conspired to create the offshore zone, populate it with imitation banks and shell companies, and sell them to a motley crew of clients from around the world. The customers — from a Swedish Hell’s Angel to a Liberian diplomat to an ersatz American archbishop — used the new entities as they pleased, with no oversight.

In fact, oversight in Gambia was impossible, since the entire offshore zone was concocted in London. Although Gambian officials tried in 2016 to disavow it and warn buyers away, there was only so much they could do.

In the United Kingdom — where Formations House is based, and therefore the only jurisdiction where it could be brought to heel — the company did attract some official attention. Its founder, Nadeem Khan, was investigated by British police for serious financial crimes, and the country’s top anti-money-laundering regulator warned the company that it could face prosecution for failing to comply with regulations.

House of Legal Woes

British authorities charged Formations House founder Nadeem Khan in April 2014 with alleged involvement in a 100-million-euro fraud case. He was accused of facilitating money laundering through companies linked to Formations House, including Accounts Centre. But he died in September 2015 at age 54 before he could be tried.

But there appears to have been no further sanction, even as Formations House continued to create sham companies for clients around the world. It is still doing business today — and although it claims to no longer be selling companies in Gambia, its erstwhile partner O’Mara is still selling fake banks.

In a statement to journalists Formations House owner Charlotte Pawar, said the leaked data had been reported as stolen, and that the firm has faced extortion attempts. She did not respond to specific questions about the company’s Gambian operations, other than to insist that Formations House’s work there was legal and the Gambian government had never said otherwise.

Fraud in an Empty Field

The full scope of what O’Mara’s 150 sham banks were used for may never be fully known. But at least some of them were used for major fraud. In separate cases, two of the Gambian “banks” he created issued letters of credit in Bangladesh that were allegedly used to steal almost $190 million in 2017 and 2018.

At least 17 of the fake Gambian banks managed to obtain SWIFT codes — a key badge of legitimacy in the banking world — by presenting their bogus documentation to the Belgian company that issues the identifiers. A handful were able to get registered or even licensed in countries that supposedly have rigorous oversight, including Sweden and the UK.

And O’Mara is still selling banks online. He boasted to a journalist that he was now the “main worldwide agent” for offshore banks in Gambia.

A top Gambian banking official, however, told OCCRP that this was untrue.

“I can confirm we have not licensed any offshore bank,” said Dr. Seeku Jaabi, the deputy governor of the country’s Central Bank.

Formations House set up the structure for this entire web of deceit under the auspices of the “Business Enterprise Zone,” an offshore free-trade zone the company’s founder had pitched to the Gambian government in 2013. However, the scheme was never actually legalized — or even approved. Though originally envisioned as a 500-hectare physical campus bustling with office workers, luxury apartments, and glitzy shopping centers, the site today is nothing more than an empty field.

Jaabi told OCCRP he had never heard of Formations House’s registry or offshore zone, and that only the Central Bank could license banks in Gambia. He expressed surprise when informed of O’Mara’s two live websites hawking Gambian financial institutions, BuyBankNow.com and GambiaBEZ.com.

Although Gambia hadn’t adopted the legislation Formations House needed to set up its offshore zone, the firm moved ahead with registering thousands of companies there, including the dozens of fake banks.

Despite being technically headquartered in a Gambian field, many of them have names that misleadingly hint at high-level connections or government backing. They include Swiss General Bank & Trust, Royal Bank of Wales, Bank of the West Indies, and New York Dow Jones Bank. Some of these “banks” also claim to operate out of major financial centers such as London and New York City.

As bank-named companies began to mushroom inside the “Business Enterprise Zone” in 2015, Gambian citizens and regulators watched helplessly. A lawyer based in Banjul, Amie Bensouda, was the first to raise the alarm, after she began looking into the registry on behalf of a client. Her inquiries led Gambian officials to convene a task force to investigate. In 2016 they issued a public announcement saying that the zone was illegal.

But though some Formations House clients saw the notice and complained, O’Mara’s so-called banks still found buyers. To lure them, the salesman and his close associate, a Formations House staffer known as “Oliver Hartmann” who handled Gambia company registrations out of the company’s back office in Pakistan, made lavish claims. Even O’Mara’s Skype handle, “Offshore Bank Genie,” suggested that setting up a Gambian bank could be magically easy.

In one breathless sales pitch, shot through with capital letters and exclamation points, Hartmann told a client that Formations House’s proposed offshore zone in Gambia was “similar to Hong Kong … whereby its rules and laws are separate to the rest of the country.”

Who’s the Real Oliver Hartmann?

Oliver Hartmann was a Formations House staffer fluent in German and English who presented himself to clients as a European. One customer even asked: “Can I count on your Teutonic efficiency? :-)”

“For this reason,” he continued, “the jurisdiction for business is very secure for international trading and high asset companies.”

But there were other reasons Gambia was an ideal place for Formations House to set up shop. For one thing, it seemed easier than in many other countries to get away with creating a company with the word “bank” in its name, and there were so few banks that many names were available.

Taking advantage of that fact, Formations House charged clients 5,000 British pounds to create a “bank-named company” for them. (The firm’s most basic offering, a simple shell company without the word “bank” in its title, cost just 175 pounds.) Adding features such as banking software and a SWIFT code could bump the price up to around 15,000 pounds.

Formations House also offered the option to apply for a “provisional banking license” at a cost of 25,000 pounds, or a full license for more than 100,000 pounds. But these options found few takers. Not only were the licenses not officially sanctioned — a fact that Formations House concealed from its customers — they were pointless.

In a frank email to Hartmann and Pawar, who were worried that not enough people were buying these licenses, O’Mara laid out the problem: Nobody wanted a Gambian bank for actual banking purposes. Rather, Formations House was selling an “image upgrade” that would enhance their credibility while they did as they pleased.

“I can tell you that the core business we have going here are small companies wishing to take on the ora [sic] of a bank and the majority of these honestly don't need any kind of bank license,” O’Mara told Pawar.

He argued that any person or company — not just banks, real or fake — can try to issue letters of credit or financial guarantees. “A good portion of the banking business is not forbidden to general business corporations in almost all jurisdictions,” he explained.

That’s why the 100,000-pound Gambian banking licenses Formations House was offering were worthless to his customers. All they did was restate in official language what a shell company could do anyway.

Even the 5,000-pound “bank-named companies” were a hard sell, since they cost 18 times more than a normal shell company but did not come with any bells and whistles, O’Mara complained.

He urged Pawar and Hartmann to upgrade the aesthetics of their offerings by providing more official-looking documents to clients — preferably printed on “fancy Gambian paper” — to make them feel like they were getting more for their money.

He went so far as to concoct a fake operating permit for Gambian banks and offer it to clients without permission from Formations House.

“My concern is Michael has started to print anything he wants,” Pawar wrote to Hartmann after they learned of this.

He had. But O’Mara defended the fake permits, insisting they were not just harmless, but critical to winning new clients. He glibly asked for retroactive permission to issue them.

“[It] is really nothing more than a repetition in a fancy form of their rights and powers…. We are really doing our best to sell these companies for you and this is an additional document which makes it possible and costs nothing to issue and is a further step to the purchase of the license.” He told Pawar that, in any case, there was nothing Formations House could do to control the bank-named companies it had already created.

“As it stands right now, unless Formations House has an army of regulators out there checking up on companies that you license, I think oversight is probably not there at all,” he wrote. “I don't think that by refusing this operating permit you will in any way stop any misuse of the companies.”

In other words, they might as well keep selling.

Michael O’Mara Speaks

OCCRP reached out to Michael O’Mara de la Fuente by email and telephone to give him an opportunity to respond to the allegations presented in this story. He declined to comment.

Despite O’Mara’s claims, there are few legal uses for a Gambian bank-named company, according to Ray Blake, a UK-based anti-money-laundering expert. “I maintain there is no evident legitimate reason why a person should buy such an entity — which is definitely not a bank as the financial community would define one.”

“You can call a banana a diamond, but it’s still a banana.”

The Birth of a Bank

No fake institution headquartered in the Business Enterprise Zone has been more prolific at facilitating fraud than Axios Credit Bank, which O’Mara and Formations House conjured out of thin air — and backed with plenty of fancy Gambian paper.

In 2017, a 25-year-old Indian businessman named Ngulminthang Lhanghal got in touch with O’Mara. A self-proclaimed “social entrepreneur” based in Bangkok, Lhanghal’s social media profiles chronicle a jet-setting lifestyle between Asian capitals. On a personal blog emblazoned with lyrics from Bon Jovi’s “Love Me Back to Life,” he describes what he calls his “journey in banking.”

Lhanghal wanted to form a Gambian bank named Axios Credit, supposedly to bolster the image of his Hong Kong-based company, also called Axios Credit. (It is unclear what this company does, but it has declared capital of just HK$10,000, or around US$1,200.)

“It's an existing finance company that wants a ‘bank’ labeling to enhance their status,” O’Mara told Hartmann of Lhangal’s inquiry in a May 2017 email.

Axios Credit Bank, Take One

The name “Axios Credit Bank” first surfaced in international media in late 2016, after Swiss space entrepreneur Pascal Jaussi dramatically produced a $30 million letter of credit to keep his floundering firm, Swiss Space Systems, from going bust.

Because Formations House was scrambling at the time to get the Gambian government to recognize its enterprise zone, and had temporarily stopped creating new “banks,” O’Mara worked with Hartmann on an elaborate scheme to make Axios a reality: They created a new shell company, Financial Trust & Guarantee Bank, then registered one of O’Mara’s own Gambian shell companies as its owner.

Next, the two men pretended the new company had been incorporated in January 2015 — O’Mara reminded Hartmann to pick a working day. O’Mara’s shell company then sold Financial Trust & Guarantee to Axios Credit, and arranged for it to be renamed Axios Credit Bank.

As they were readying the papers for the new “bank,” O’Mara joked to Hartmann about how much official letterhead he was churning through: “[C]an you ask Formations House to send me some more blank Gambian stationery as I need to do for them certificates for each director, certificate of no debts and liabilities , etc.. (After all the certificates and documents for Bernardo I ran out! Lol lol!).”

How Fake Banks Got Real SWIFT Codes

A SWIFT code, issued by the Belgium-based Society for Worldwide Interbank Financial Telecommunication, is essentially an ID number for banks and other financial institutions. Some are “connected” to a wider network that allows them to communicate with other banks worldwide; others act more like reference numbers. But because SWIFT is a well-known international institution, even the simpler version lends prestige and an aura of legitimacy.

In an interview, O’Mara told OCCRP that he always carried out due diligence, including anti-money-laundering checks.

“We have to see that you don’t have a criminal background, that you have sufficient wherewithal, capital, and so forth, to be able to run a banking operation, and general competence,” he said.

But there is no evidence in the leaked emails that O’Mara checked out Llanghal at all. On the contrary, the salesman seems to have invented a figure of 50 million British pounds to list as the new bank’s share capital. Then he told Llanghal he could change this number to whatever he wanted, in any currency.

Llanghal’s reply is not recorded, but O’Mara and Hartmann ultimately produced a certificate for Axios claiming that it had 50 million US dollars — not pounds — in capital.

To direct his new “bank,” Lhanghal appointed a friend, Paween Sirirak, a 28-year-old Thai beauty salon owner. (Paween told OCCRP he was not a director of Axios and had never heard of it, although in 2017 he posted a photograph of himself on his Instagram page tagged “Axios Credit Bank Ltd.”)

The papers cobbled together by O’Mara and Hartmann looked plausible enough for Axios to issue a string of letters of credit that were used to allegedly defraud banks and investors in Bangladesh, India, and Pakistan to the tune of $163 million.

Although the frauds have been individually covered by local newspapers in those countries, this is the first time their origin has been traced to Formations House’s Gambian operation.

The biggest thefts took place in Bangladesh. Between January 2017 and February 2018, Axios Credit Bank issued 221 letters of credit on behalf of a group of shell companies, mostly based in Hong Kong, that guaranteed payment for shoe and leather goods exports from a Bangladeshi firm, Crescent Group.

A Bangladeshi state-owned bank, Janata, backed the deal, promising to pay Crescent for the goods on the back of Axios’s letters of credit. It disbursed $163 million to Crescent after the exporter claimed to have dispatched the shoes, according to reports from the Bangladesh Financial Intelligence Unit and the country’s Anti-Corruption Commission seen by OCCRP. But no goods appear to have ever been sent and Axios did not honor its commitment to guarantee the shipment — because it had no capital and wasn’t really a bank — leaving Janata out of pocket.

Bangladeshi authorities said Janata should have realized that the letters of credit issued by Axios were “illogical,” “abnormal,” and “suspicious.” It listed a litany of red flags, including the fact that Axios was a Gambian bank with no obvious tie to the importers’ country.

It is not clear whether any of those involved realized that Axios wasn’t a real bank. In another case in Pakistan, Axios Credit Bank is enmeshed in a commercial dispute involving a $500,000 guarantee for the export of food products to Dubai. However, the judge in the case chastised the plaintiff for failing to report Axios to Gambian banking authorities — again, without understanding that the company is not a registered bank in the African country.

OCCRP has also linked Axios Credit to a court case and a police investigation in India. In January, a Dubai businessman was arrested for allegedly tricking a rice exporter in 2017 into sending almost $250,000 worth of rice to Dubai, also based on a letter of credit from Axios. A month later, Axios Credit surfaced again in a Gujarat court case involving an impounded ship whose owner submitted a guarantee from the fake lender to secure its release.

Abdus Salam Azad, the CEO and managing director of Janata, said the fraud had seriously weakened his bank’s financial position.

“We could not imagine that our money would be lost through an anonymous bank from Gambia, so far away from Bangladesh,” he said.

Frauds involving fake banks are relatively rare, because most jurisdictions have licensing and supervision requirements that make it difficult to blatantly impersonate a financial institution, according to Blake.

“[A]ll reputable jurisdictions will ensure that people can trust their financial regimes; it is not in their interests to allow spurious players to act as banks without the secure guarantees that proper licensing and supervision would ensure,” he said. The fake banks created by Formations House, squatting in a virtual version of Gambia, opened up space for an exception.

Axios Credit told OCCRP that other banks and prospective creditors should have been aware that it had “very weak reliability,” and taken its guarantees with a grain of salt.

“If they still proceed to grant some sort of credit lines or loans to their customers based on our instruments then we believe it is their own mistake,” said Lawrence Cheah, the bank’s current owner.

Axios Credit Bank Shareholders’ Responses

OCCRP reached out to Axios Credit Bank for comment on the allegations presented in this story. Its current co-owner, Lawrence Cheah, said he had purchased Axios Credit from Ngulminthang Lhanghal in February 2017 — before it was even created by Formations House.

It wasn’t just Axios. Bangladesh was hit with a similar "letter of credit" fraud in 2018 that allegedly involved another fake Gambian bank, Pan Pacific. The goods for “sale” that case were terra-cotta tiles rather than shoes and leather goods, but otherwise the scheme — in which $23 million was stolen — was nearly identical.

Prior to both cases, in December 2016, Britain’s revenue and customs authority had already warned Formations House that it was failing in its due diligence requirements, and could face criminal prosecution if it did not put proper procedures in place to assess clients. It also ordered Formations House to “review existing customers.” (Pawar told OCCRP in a written statement that Formations House had updated its due diligence procedures following the inspection.)

OCCRP and its partners have found a consistent pattern of due diligence failures in Formations House’s registration services. Many of those interested in buying Gambian banks and companies had a track record of irregularities.

Ahmed, the Pakistani man who sold companies for years under the alias Oliver Hartmann, said he was never asked to perform due diligence checks on those seeking to register banks or firms, and received no training on how to do so.

“The way people use companies is up to them,” he said. “Ours was a kind of business startup service. Our bosses used to say it is up to [clients] how they use them.”

He added that he had never personally come across a suspicious client.

A number of Formation House clients had histories that might have warranted a closer look. Here are just a few examples.

Iranian Oil in a Gambian Shophouse

In addition to fake banks, Formations House registered thousands of fake firms in Gambia. Most appear to be shell companies or relatively small enterprises. But in at least one case, a real company — a major, state-owned Iranian oil trader — was behind the “ghost” entity that Formations House created on its behalf.

Naftiran Intertrade is the trading arm of the state-owned National Iranian Oil Company. Between 2008 and 2016, the U.S. maintained sanctions on Iranian state entities over the country’s refusal to dismantle its nuclear program, as did the EU. The U.S. reimposed sanctions in November 2018 after withdrawing from the multilateral nuclear deal that ushered in the temporary reprieve.

Naftiran had spent years dodging these restrictions by hopping around the globe, including stints in Jersey and the Malaysian island of Labuan.

But between December 2014 and February 2016, the company was registered in Formation House’s phantom Gambian registry. It is unclear whether anyone at Naftiran ever realized that the registry was not legally sanctioned.

In 2016, Naftiran left Gambia and decamped to the Caribbean microstate Saint Kitts and Nevis. Once there, it claimed that its previous home had been an address in Banjul, the Gambian capital. An OCCRP reporter visited the address and found a Western Union branch that has been there since 2012. The building’s landlord said he had never heard of Naftiran.

In an emailed response to questions about her firm’s work for Naftiran, Charlotte Pawar said: “Iran sanctions enable UK to trade with Iranian individuals and companies where their industry is outside any embargoes and where the UK supplier ensure they take enhanced Due Diligence.”

However, Iran’s oil company was under sanctions at the time.

“Prestige Items”

Running a successful fake-bank-sales shop required not just a flexible interpretation of due diligence, but a keen understanding of human nature. O’Mara had both in abundance. The leaked emails reveal him to be a consummate salesman who understood exactly what kind of person would buy a Gambian bank — and why.

He realized that many potential clients cared little about the legitimacy of the entities formed on their behalf as long as they had a name and documents that lent them credibility.

In his emails with Formations House staff, he was frank about the “psychological ploys” he used to convince customers around the world that a Gambian bank could improve their lives, and frequently pushed the company to upgrade its offerings.

“I am thinking of a new marketing angle … to sell these as a "prestige item" saying that even though they can't take deposits like banks, they can do just about every other business banks do,” O’Mara wrote at one point.

“[T]he more bulk of paper we can give them, the happier they are and the more eager they buy,” he wrote in October 2015. “People feel they get more this way and its paper, which at the end of the day, costs us nothing.”

In another exchange, O’Mara explained to Hartmann why he was offering potential clients four off-the-shelf bank names, as well as two tonier-sounding institutions — Luxembourg Credit Investment Bank and Royal Bank of Norway — that he would tell buyers were hugely expensive.

“The first four are the once [sic] we are truly marketing,” he wrote, “but it looks good to have a couple more, though completely unavailable in real terms to make it look like there is more variety; i.e., a marketing ploy.

“I don’t like to give too many choices of available banks because it reduces the client’s feeling that they must act with heist [sic] otherwise there will be no available banks,” he added.

Formations House tried not to sell companies that too closely duplicated existing bank names, but O’Mara workshopped options with his clients to come up with the perfect combination of prestigious-sounding but not patently fraudulent. He then used all his skills as a salesman to push Formations House to accept riskier and riskier options.

On one occasion in 2016, a customer asked O’Mara to help him register Gambian companies called “Credit Agricole” (a leading French bank) and “Santander” (a Spanish bank). Rather than viewing this as a warning sign, O’Mara sprang into action.

“I am really eager to get this client! He's got money and is quite ready to buy,” wrote O’Mara to Hartmann.

“Are the Agricole names still on?”

O’Mara was told that names containing Agricole were possible, but Santander was off-limits. He pushed back in a furious 700-word email: “I do not see Charlotte's reasoning at all...Santander is the name of a secondary city in Spain. She allowed some use of the Zurich name and Zurich is very banking-related....Santander nothing! Santander is known for its cider at best — it is no banking centre of any kind.”

Ultimately, he found a workaround to give the client what he wanted: a name with a sense of gravitas, rooted in European history. They settled on Caixa de Ahorros de Badalona — the “Savings Bank of Badalona,” a small town near Barcelona.

Like all the best salesmen, O’Mara believed in his own pitch. In 2016, he created his own fake Gambian offshore bank, which he then used to accept payments from clients for their fake Gambian banks.

He named his company The Hong Kong Merchant Banking Corporation (HKMBC), despite its having no known connection to Hong Kong, and arranged for it to be owned by another Gambian shell company he had established, Holy See of the Patriarchate of Jerusalem Ltd.

“The Patriarchate will own HKMBC in its entirety and will be its sole director and shareholder,” he wrote to Hartmann.

“I would like to structure it so that the Patriarchate is its own director and its own shareholder as well. If this is not possible for any reason, please let me know.”