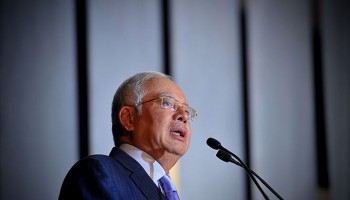

In 2012 and 2013, Goldman raised US$6.5 billion through bond sales for 1MDB, the Malaysian state fund embroiled in controversy over allegations that it was looted of more than $4.5 billion under the watch of former Prime Minister Najib Razak.

Of the $6.5 billion made through the bond offerings, investigators say $2.5 billion was embezzled by Malaysian senior officials. As part of the deals, Goldman pocketed an unusually large $600 million in fees for its work selling the bonds.

Tim Leissner, the Goldman banker who oversaw the 1MDB account, reportedly received several hundred thousand dollars from Jasmine Loo, a former 1MDB official, and Jho Low, a Malaysian businessman who was central in setting up the fund, the Wall Street Journal said.

Leissner resigned from Goldman in early 2016 shortly after being suspended for having written an unauthorized and inaccurate reference letter for Low in June 2015.

He is accused of deliberately misleading senior Goldman executives about how proceeds from the 1MDB bond sales would be used.

If a plea deal is reached, Leissner would become a key witness against his former superiors in the Department of Justice investigation into whether Goldman violated the Bank Secrecy Act.

Under the Act, financial institutions are required to maintain robust internal protocols to prevent money laundering, with increased vigor mandated for transactions connected to politically exposed and foreign individuals.

So even if Leissner withheld significant details from his superiors, the bank could still face legal trouble for not exercising enough due diligence when conducting financial transactions for the foreign state fund. According to Bloomberg, such failure of their internal compliance procedures could leave Goldman open to charges of wire fraud and a conspiracy to launder money.

Malaysia’s new government led by Prime Minister Mahathir Mohamad, who came to power vowing to bring Najib and all those involved in the 1MDB scandal to justice, has said it wants to recoup some of the $600 million from the bank.

Goldman, however, has consistently denied wrongdoing in the 1MDB controversy.

“We helped raise money for a sovereign wealth fund that was designed to invest in Malaysia,” said Edward Naylor, a spokesman for Goldman Sachs. “We had no visibility into whether some of those funds may have been subsequently diverted to other purposes,” he said according to the New York Times.

Since Malaysia ousted Najib in May, international probes have been reinvigorated into the 1MDB case, including by Singaporean, Swiss and U.S. authorities.

Last month, authorities arrested Najib on three counts of criminal breach of trust and one count of corruption.