In an emphatic sign that ambitious young real estate brokerage Fidu Properties had made its mark in Dubai, the company’s logo was emblazoned along the length of the Burj Khalifa, the world’s tallest skyscraper.

The honor in 2019 marked a rapid ascent for Fidu, which had been set up barely two years earlier. Its success was aided by a partnership with Emaar Properties PJSC, Dubai’s largest property developer that is part-owned by the Dubai ruler’s investment vehicle.

Within a few months of opening its Dubai office in 2018, Fidu and Emaar struck a $100-million deal in one of the developer’s luxury projects, The Grand at Dubai Creek Harbour, according to press reports. By 2019, Emaar-built developments accounted for at least 90 percent of Fidu Properties’ sales, according to Fidu press releases.

But in August last year, Su Jianfeng, a key figure behind Fidu, was arrested in Singapore in a dramatic bust of an alleged money laundering ring that has since led to the seizure of more than $2.2 billion in assets. Singapore police have charged 10 people with laundering the proceeds of illegal online gambling and scam operations across southeast Asia. Su Jianfeng was also the subject of a 2017 Chinese arrest warrant for illegal gambling.

Six of the people arrested have already pleaded guilty and been sentenced. Su Jianfeng is in detention in Singapore awaiting trial.

Now, an investigation by OCCRP and The Straits Times, based on leaked property data from Dubai, reveals that Su Jianfeng and two other people arrested in the money laundering case invested more than $30 million in Dubai real estate, through projects mostly developed by Emaar and brokered by Fidu.

Three other people named in connection with the case own properties worth over $40 million. One of them shares an address with two men who, like Su Jianfeng, are wanted in China for illegal gambling, and they too own significant real estate assets in Dubai.

While the Singapore bust was widely covered, these Dubai property purchases have not been reported until now. As OCCRP went to press on Su Jianfeng was handed six new forgery charges, including allegations related to five properties in Dubai, of which three appear in the leaked records.

Taken together, the newly-discovered purchases involve over 100 properties, bought for more than $100 million in total, according to the leaked data. They include units comprising entire floors of the Grande Downtown, a luxury skyscraper opposite the Burj Khalifa, worth at last $47 million. The purchases all occurred between October 2019 and October 2020.

While such “high volume property investments” are not “automatically tied to money laundering,” they “can definitely be a red flag,” said Benedikt Hofmann, the deputy representative for Southeast Asia at the United Nations Office on Drugs and Crime.

Many of the properties identified by reporters were in other flagship Emaar developments in Downtown Dubai, and The Grand at Dubai Creek Harbour, both advertised and marketed by Fidu Properties. (There is no suggestion Emaar knew about Su Jianfeng’s background or his alleged money laundering activities.)

The investments raise questions over whether Dubai’s notoriously light-touch approach to due diligence allowed members of the alleged money laundering ring to move suspect funds into Dubai property.

Alex Cobham, the head of financial transparency campaign group Tax Justice Network, said regulators should have “a requirement to establish the source of funds.” Since 2019, realtors in Dubai have been legally obliged to carry out anti-money laundering risk assessments.

The tie-in with Su Jianfeng and Fidu could be embarrassing for Emaar and, by extension, Dubai’s ruler, Cobham said, but added that the case could serve as a catalyst for improving regulations in the emirate.

“The Royal family is arguably [a victim] of the complete failure of any regulatory standard, and the bad press this generates,” Cobham said. “Either way, it’s on them to change this, as they preside over the entire system.”

About the Dubai Unlocked Investigation

UAE officials — including at the ministries of interior, economy, and justice — and Dubai Police did not respond to detailed questions from reporters. UAE embassies in the U.K. and Norway sent a brief comment saying that the country “works closely with international partners to disrupt and deter all forms of illicit finance.”

“The UAE is committed to continuing these efforts and actions more than ever today and over the longer term,” the statement added.

Emaar Properties did not reply to written requests for comment.

Fidu Properties and Su Jianfeng’s lawyer did not respond to emailed requests for comment.

Suspects’ Properties

On videos posted to Fidu’s social media accounts, Su Jianfeng presents as a boyish and modestly dressed executive — yet clearly in charge. He leads Fidu executives into a black-tie gala event to rapturous applause from employees in one video. In another, he presides over the opening of a second company office in September 2019, cutting a large red ribbon as staff clap.

Despite the Chinese warrant for his arrest, 36-year-old Su Jianfeng — who holds Chinese, Cambodian, St Kitts and Nevis and Vanuatu passports — was able to pour huge sums into Dubai real estate.

Between 2017 and 2020, Su Jianfeng purchased at least 10 apartments and two villas in Dubai, worth at least $15 million, according to leaked transaction data reviewed by OCCRP.

In April 2019, he co-founded Fidu Properties DMCC, an affiliate of Fidu Property Real Estate Brokerage that had been incorporated in Dubai in late 2017.

Fidu Properties DMCC is based out of Dubai’s free-trade zone, where foreign investors can take advantage of tax breaks, ease of capital transfer, and the right to full foreign ownership. He controls a 50 percent stake in the company and is one of two directors, Dubai company records reveal.

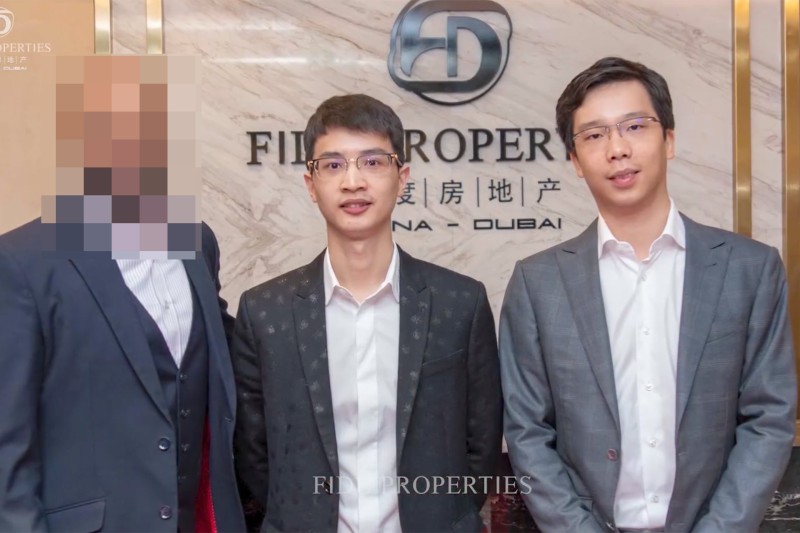

The other half of Fidu Properties DMCC is held by Su Sihai, who is the sole shareholder of the affiliated company, Fidu Property Real Estate Brokerage. Su Sihai has not been implicated in the Singapore money laundering case and has not been charged with any crime. He declined to comment on his connection to Su Jianfeng.

In the wake of the 2023 arrests, Singapore police seized more than $170 million worth of assets in Singapore belonging to Su Jianfeng, including at least 13 properties there worth over $85 million.

Two of Su Jianfeng’s alleged co-conspirators also own property in Dubai. One of them, Su Haijin, has already pleaded guilty and in April was sentenced to 14 months imprisonment.

Like many of the other arrested suspects, Su Haijin has sizable asset portfolios all over the world, as reported by OCCRP.

But the leaked data reveals previously-unreported properties in Dubai, including 11 apartments worth an estimated total of at least $11 million. The units made up the entire 58th floor of the Grande Downtown, the luxury Emaar development opposite the Burj Khalifa.

Lin Baoying, a Dominican and Cambodian national, is the third person arrested by Singapore police who has newly-revealed Dubai assets. She owns a luxury villa at Emirates Hills, an Emaar development, worth at least $7 million. She is in Singapore awaiting trial.

Su Haijin and a lawyer for Lin Baoying did not respond to requests for comment.

Multiple Floors in Luxury Skyscraper

The Emaar Connection

Emaar, backed by the Dubai ruler’s investment fund and the emirate’s sovereign wealth fund, had identified China as a crucial market for its long term growth strategy in 2018, the same year Fidu Properties opened its local office for business.

Emaar’s Chinese language billboards advertising key projects have since popped up along highways in Dubai, and the company’s name written in Chinese is featured during the Dubai Fountain Show, a nightly tourist spectacle centered on the Burj Khalifa.

Emaar's largest shareholder is the Investment Corporation of Dubai, the emirate's sovereign wealth fund, which owns roughly 22 percent of the company’s shares. The second largest shareholder is Dubai Holding, the investment vehicle of Sheikh Mohammed bin Rashid Al Maktoum, Dubai’s ruler.

Dubai Holding was also Emaar’s joint venture partner for the Dubai Creek Harbour master project, of which The Grand at Dubai Creek Harbour — which Fidu brokered — is a key part.

Emaar works with multiple brokers, but Fidu’s website boasts that it has earned “top platinum broker” status with Emaar, indicating it was one of the developer’s most important partners. The website also says Fidu won fourth place in Emaar’s 2019 top broker awards, and was the top Chinese real estate brokerage in Dubai that year.

The ties between the firms’ leading figures are suggested by multiple photo-ops with top Emaar executive Mohamed Alabbar and Fidu’s senior staff members, as well as personal visits by Fawaz Sous, Emaar’s then head of sales, to Fidu’s offices. The photos have been published on the two companies’ websites and social media.

Emaar CEO Amit Jain has also been photographed with Su Sihai, Su Jianfeng’s partner in Fidu.

When Su Jianfeng applied for bail in October 2023, he told a Singapore court in an affidavit that he had worked as a property agent in Dubai and had earned substantial referral commissions which constituted legitimate funds brought into Singapore.

The courts rejected his request for bail as he was unable to provide verifiable documentation of either his employment or real estate transactions.

Fidu is still in business in Dubai, and its website touts a “strong association with globally renowned developer” Emaar.

Despite his ties to Fidu, Su Jianfeng does not appear among the list of 25 staff featured as part of the firm's team on the website.

However an archived version of the site from 2020 profiles Su Jianfeng’s partner in Fidu, Su Sihai, and names him as CEO. It shows a group photo featuring the pair standing at the center, surrounded by other staff. The profile, and the photo, have since been taken down.