Suspected members of a massive money laundering syndicate busted in Singapore last month purchased prestige properties in London in 2021 worth almost $60 million, company and land records reviewed by OCCRP and Radio Free Asia reveal.

The investments highlight the global reach of a syndicate that Singapore police say laundered the proceeds of illicit “scams and online gambling.”

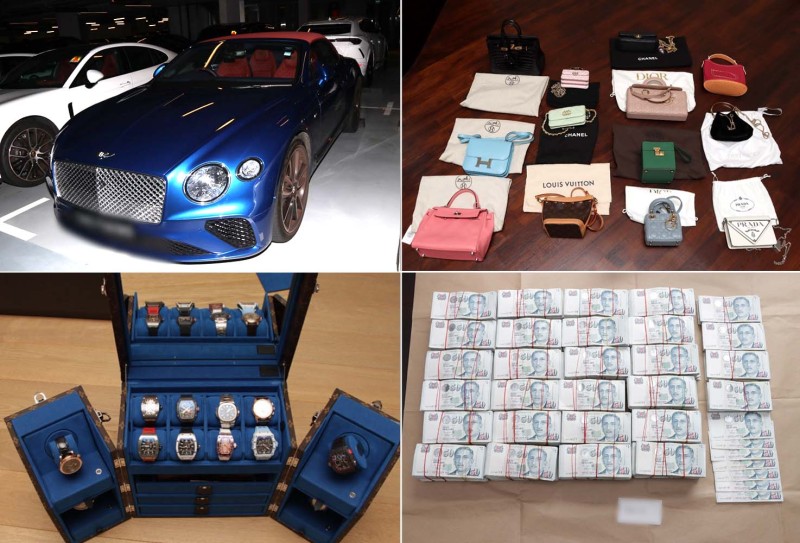

More than 400 officers swept in on multiple locations in the Southeast Asian city state in mid-August, arresting 10 people. Prosecutors said in a September 5 court hearing that they had seized at least $SG1.8 billion ($1.32 billion) in cash, cryptocurrencies, and assets including expensive handbags and jewelry.

Police said at the time of the arrests that they had confiscated 50 vehicles and 94 properties in Singapore, which were together worth almost $600 million. Reporters have now discovered three London properties owned by two of the suspects that were purchased in December 2021 for a combined total of $56 million.

The biggest transaction involved the simultaneous purchase of two adjoining properties in Oxford Circus, the city’s top shopping district. They were acquired jointly by a Jersey-based entity called New Yihao Limited that listed Su Haijin as its only "individual beneficial owner," according to a registered overseas entity document published by the U.K. business registry.

Su was arrested in Singapore with at least $117 million of assets linked to him and his wife, including 13 properties, five luxury vehicles and cash accounts, according to the police statement and the September 5 court hearing.

However, the U.K. real estate holdings uncovered by the OCCRP and Radio Free Asia are the largest single assets publicly tied to Su so far.

The adjoining properties are in a multi-story heritage building, with one overlooking the elegant Hanover Square. The other faces bustling Oxford Street, and has been leased to sports retail giant Foot Locker since before the 2021 sale, according to U.K. land documents.

About a week before the Oxford Circus sale was settled, Lin Baoying, another suspect arrested in Singapore, purchased a penthouse apartment in a luxury residential skyscraper in Canary Wharf, London’s premier financial district. Land records show that she paid 1.8 million pounds ($2.2 million).

No mortgages were registered against any of the London properties, suggesting the suspects paid for them in cash.

Lin and her partner Zhang Ruijin were reportedly arrested together in Singapore’s exclusive Sentosa Cove, with authorities confiscating over $100 million in assets and cash from the pair, according to prosecutors’ estimates, including bank accounts totalling $16 million that were frozen by the police.

Lawyers for Su, Lin, and Zhang did not respond to requests for comment. The Singapore Police Force and prosecutors said they could not comment on ongoing investigations.

From a Bungalow to the Drain Below

As officers descended on his luxury Singapore bungalow on August 15, Su attempted an audacious but ill-fated escape, leaping from his second-floor balcony over the railing and fracturing his wrists, femur, and heels upon landing. Su then crawled to a drain and hid, where he was apprehended by authorities.

Like the other arrested suspects, Su hails from China’s Fujian province, a region famous for both its tea plantations and criminal underworld. He has held a Chinese passport, and has passports from Cambodia and Cyprus, according to citizenship data acquired by reporters.

According to an interview given by his lawyer, Su first arrived in Singapore in 2017. He soon made his mark, investing in a stock market-listed food and beverage group that runs a popular seafood restaurant chain, according to company registration documents. He also reportedly invested in a mobile phone dealership and an air conditioner company. Su was a member of the Sentosa Golf Club and sponsored the Singapore President’s Charity Golf Tournament, the Straits Times newspaper reported.

China company registry data shows that Su and his wife, Wu Qin, also a Cypriot citizen, control a handful of technology and investment companies that do not appear to have tangible operations or websites. The pair also control several Hong Kong companies, which are mostly registered with HK$1 ($0.13) in capital, while Su is listed as the chairman of one company in Cambodia.

Casinos and Scams

Illegal online gambling and scam operations –– like those allegedly run by the suspects arrested in Singapore –– have expanded rapidly across Southeast Asia in recent years. The operations are often run out of casinos, the number of which ballooned to at least 350 throughout the region by 2022, according to an OCCRP tally based on regulator reports and document from the United Nations Office on Drugs and Crime. Many operate illegally in poorly-regulated special economic zones and target bettors in mainland China, where gambling is banned.

Among the victims are many of the scammers themselves, with hundreds of thousands having been lured to the facilities under false pretenses and then forced to participate in the fraudulent schemes, according to the UN.

It’s a multi-billion dollar industry, and laundering the illicit proceeds is a major undertaking. Singapore’s deputy prosecutor, Gan Ee Kiat, said authorities are coming to grips with the “scale and developing complexity” of the case, local media reported.

Gan said that several of the suspects had “considerable” overseas wealth and assets, including real estate, without divulging details.

Corporate records from the self-governing U.K. territory of Jersey show financial service provider Fiduchi Group helped set up New Yihao’s structure just two months before the real estate purchases.

Jersey registry data also shows one of Fiduchi’s clients is a luxury yacht brokering firm called Imperial Yachts. That company and its owner, Evgeniy Kochman, were both sanctioned last year by the U.S. Treasury for helping Russian oligarchs “hide, move and maintain their wealth and luxury assets.”

Fiduchi did not respond to a request for comment.

The U.K. company registry documents don’t reveal New Yihao’s full corporate structure, but simply stipulate that Su holds “directly, or indirectly, more than 25 percent of shares in the entity.”

“The documents effectively tell you that Su is the sole registered beneficial owner at the end of the chain, even if we don’t have a full picture of the exact corporate structure,” said Alex Cobham, chief executive of the Tax Justice Network, a U.K.-based advocacy group.