On a Hungarian TV news program in 2008, a businessman promoted a big investment plan: the construction of two bioethanol factories in neighboring Romania that would buy up crops produced by farmers and turn them into fuel.

“I think it will provide a good livelihood for them,” said Erik Bánki, identified as the Hungarian manager of HP Investment, a Romanian company proposing to invest €70 million to build one of the factories.

Bánki wasn’t merely a businessman — he was an influential politician. Since 1998, he has served as a legislator in the Hungarian Parliament, rising to a powerful position with the governing Fidesz Party as head of the Economic Committee.

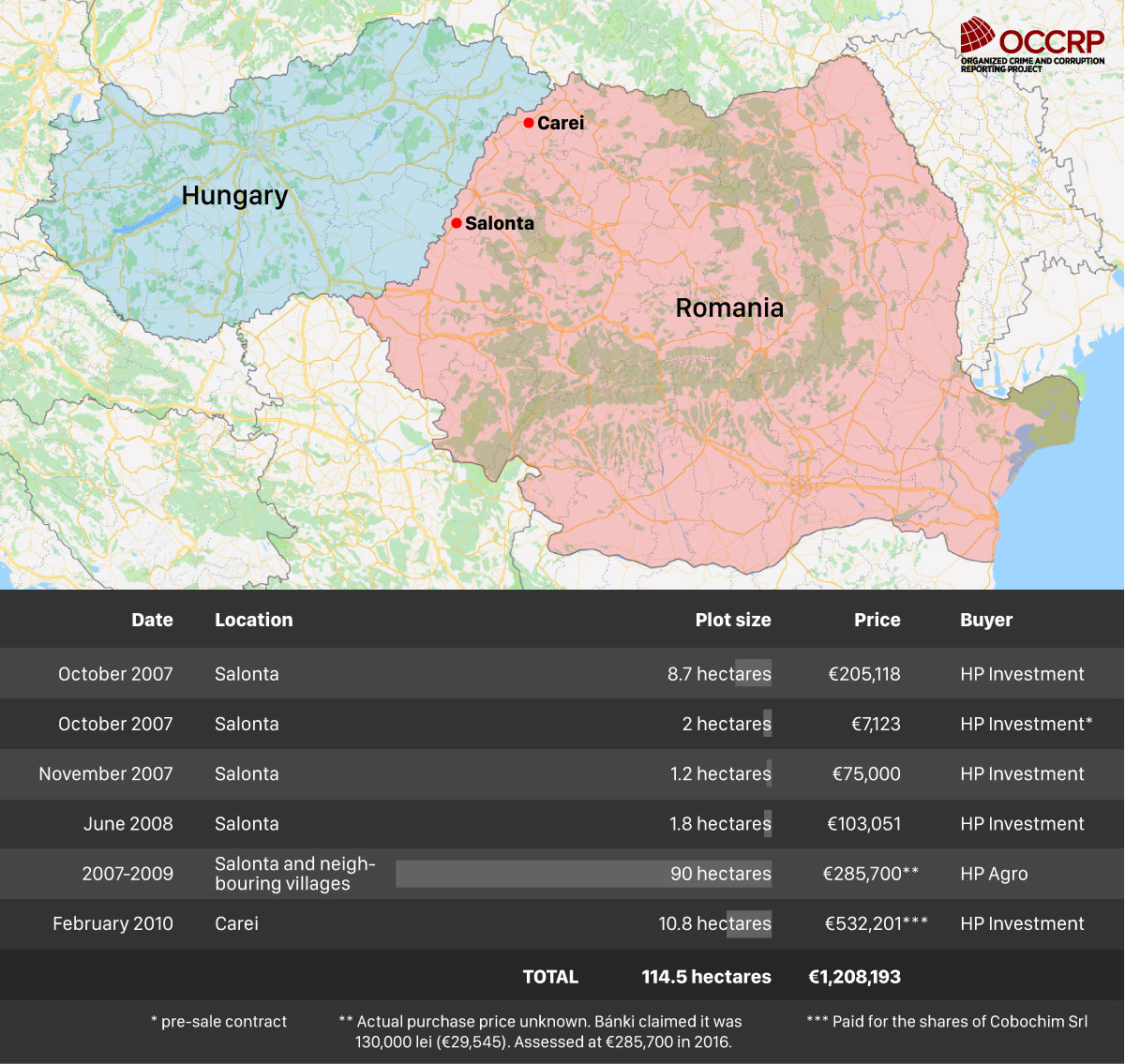

A joint investigation by two OCCRP partners, Direkt36 in Hungary and RISE Project in Romania, found that, between 2007 and 2010, Bánki spent almost €1 million through several companies to buy more than 110 hectares of land in Romania, including the proposed locations of the two factories.

He has never declared the details of his business in Romania, and the law governing Hungarian officials does not explicitly require him to do so. However, according to documents examined by OCCRP partners Direkt36 and RISE Project, the details of the deals raise serious questions.

First, there’s the matter of the acquisition of the land. Some of the purchases Bánki made required tenders from at least two companies — and the only other company that submitted a bid was co-owned by his cousin. Given his income declarations, it’s unclear where the money for the land could have come from. And his statements to reporters about possible financing for the bioethanol project are contradicted by a contract examined by reporters.

Moreover, Romanian court documents show that the promised bioethanol factories were never built and that Bánki’s companies accumulated more than €2.3 million of debt to local governments, consisting mostly of unpaid penalties due to the ultimate failure of the enterprise. These debts were eventually settled for just 17 percent of their value when authorities took over land Bánki had bought for about €390,000 in lieu of repayment.

Today, most of Bánki’s Romanian companies no longer exist, and his remaining land in the country is the subject of bankruptcy proceedings.

Partial Declarations

Hungarian law requires parliamentarians to file annual asset statements to give a full picture of their financial situation. Direkt36 checked Bánki’s declarations from 2000 to 2018, in which he reported that he has bought more than 200 hectares in Hungary since 2015, but he never declared the land bought by his companies in Romania.

The Hungarian law on asset declaration does not clearly spell out whether parliamentarians must declare only directly owned assets, or also assets owned through companies. While some deputies do declare indirectly owned assets, Bánki only declared the existence of his Romanian companies, including neither the land he bought through them nor the public debts they incurred.

Bánki told Direkt36 there was no reason for him to do so. “The assets of a company and private ownership are different things,” he said. “If real estate is owned by a company, it is not owned by a private person.” Records show that Bánki owned 90 percent of one company that purchased the land and 100 percent of the other.

Nor do Bánki’s asset declarations offer any clues about where he got the almost €1 million he spent on Romanian land between 2007 and 2010.

A review of his annual declarations and wage records from 2000 shows that Bánki’s official salary as a politician oscillated between €20,900 and €39,000 annually, while his Hungarian and Romanian companies either lost money or posted only smaller profits, not enough to cover the land purchases. The debt of one of his companies grew from about €291,000 in 2007 to €688,000 in 2010.

Bánki told Direkt36 that the land purchases were financed from loans from foreign and Hungarian companies. He said he did not remember the names of the companies, and refused to present documents that would prove the existence and the amount of the loans.

The Bioethanol Promise

Bánki has risen to an influential position in Fidesz, Hungary’s governing party, since his start in politics in the 1990s as a local official and party activist in the southern county of Baranya.

Except for a two-year detour to Brussels as a member of the European parliament between 2012 and 2014, Bánki has served in the Hungarian legislature since 1998. Although he has mostly worked in the background, since October 2015 he has headed the Economic Committee, an institution that under parliamentary rules allows Fidesz to prepare and push through legislation without substantial debate.

Bánki has also been active in business. Since the 1990s, he has co-owned nine Hungarian companies involved in real estate management, consultancy services, and agricultural production.

Bánki began his Romanian operations in 2006, when he founded HP Investment SRL, a real estate development company. According to the Romanian Commerce Registry, he has owned 90 percent of the company since its founding.

A map showing where Banki bought his Romanian land and a chart listing his purchases. Click to enlarge. (Edin Pasovic)His entry into Romania coincided with that of Duna Development Ltd., a development company then co-owned by the Austrian and Hungarian governments. Duna had been organizing alternative energy projects in Hungary and began to plan similar developments in Romania.

A map showing where Banki bought his Romanian land and a chart listing his purchases. Click to enlarge. (Edin Pasovic)His entry into Romania coincided with that of Duna Development Ltd., a development company then co-owned by the Austrian and Hungarian governments. Duna had been organizing alternative energy projects in Hungary and began to plan similar developments in Romania.

“Bioethanol factories seemed to be the most promising at that time,” said Tibor Érsek, a former manager of the now defunct Duna. Érsek told Direkt36 that, as a development company, Duna was responsible for preparing the projects, including obtaining the necessary permissions, providing technical expertise, and finding prospective investors.

In June 2007, Hungarian media reported that Duna was planning the construction of two bioethanol factories in Romania close to the Hungarian border: one in Salonta, Bihor county; and the other in Carei, Satu Mare county.

Érsek recalled that Duna negotiated with Bánki and his company to collaborate on the factories, but both he and Bánki said they did not recall whether any contracts were signed. The exact nature of the relationship between Duna and Bánki’s companies remains unclear.

But Bánki’s actions strongly suggest that he was partnering with Duna. Documents obtained from Salonta City Hall and from court records show that his Romanian companies bought land in both Salonta and Carei between 2007 and 2010, and that, in 2008, he signed a contract to build a bioethanol factory in Salonta.

Some of the land Bánki bought in Salonta. (Photo: Rise Project Romania)

Some of the land Bánki bought in Salonta. (Photo: Rise Project Romania)

Bánki appears to have benefitted from some familial help.

Salonta authorities organized the auctions in 2007 and 2008 to sell municipal land in an industrial area. The auction documents show that, in order for the sales to be valid, officials needed to receive offers from at least two companies.

Bánki’s HP Investment won two public auctions to buy the land. In both cases, the only other bidder was MSB Invest SRL, a company co-owned by his cousin, Péter Madár.

In both cases, the companies submitted their offers at the same time, and Bánki’s company offered a slightly higher purchase price per square meter than his cousin (€0.25 higher at the first and €0.05 higher at the second auction).

“It was an open competition. I only learned there, at the auction, that my cousin also bid,” Bánki told Direkt36 without specifying whether he was referring to the first or second auction.

Madár told Direkt36 that he learned about the public auctions through a “business partner.” Asked whether he knew his cousin Bánki also intended to bid and whether they had coordinated in any way beforehand, he said, “Surely not.” Immediately after the second public auction, MSB Invest SRL “ceased all its substantial activities,” he said.

Bánki’s winning bids allowed HP Investment to buy 12.5 hectares in Salonta just over €315,000. (He also bought an additional 1.2 acres from a privatized state company, paying double the price he had paid the city for the plots nearby.)

And through another company called HP Agro — an agricultural concern founded in 2007 — Bánki bought another 90 hectares in Salonta and nearby villages between 2007 and 2009, which he told reporters was meant to be used for farming after the completion of the factory.

Bánki recalled that the bioethanol project in Salonta was to be financed by foreign companies, with his company, HP Investment, acting as a project manager, acquiring the necessary land and negotiating with local farmers.

“My company did not put any money into this project, we put only our work and energy,” he told Direkt36. Bánki claimed that a company based in Switzerland, which was owned by an American investment fund, was interested in the project and pre-financed it, including the land purchases. He said that HP Investment was contracted by the investment fund, but could not recall its name or provide the contract.

In fact, the contracts Bánki signed when his company acquired the land required him to invest €70 million to build the bioethanol factory himself, and they make no mention of any other investors. He agreed to complete construction of the project by October 2009 and to hire up to 80 local residents. (First contract; second contract.)

If the company missed the deadline, it promised to pay 0.01 percent of the investment’s value each day (about €7,000) until the work was completed.

Bánki did not stop in Salonta. In 2010, he also bought land in Carei, the other town where Duna Development planned a bioethanol factory. Rather than through a municipal auction, his HP Investment obtained the land by buying a Romanian company called Cobochim SRL. The deal was valued at over €532,000, according to Romania’s official gazette.

Bánki’s land in Carei. (Photo: Rise Project Romania)

Bánki’s land in Carei. (Photo: Rise Project Romania)

Unlike Salonta, however, Bánki’s company did not sign any contracts with Carei officials about bioethanol investment. No factory was ever built there. Cobochim went bankrupt in 2016 and its land is now subject to bankruptcy proceedings.

Forgotten Loans

A review of the financial reports of Bánki’s Romanian companies indicates that they never made enough profit to cover the land deals. HP Investment spent more than €922,000 to buy land and acquire a company between 2007 and 2010, while its debts grew from about €291,000 to €688,000 during that period.

Bánki said the additional money came from loans, but could not recall who loaned him the money, or provide any supporting documentation.

“This growth in debts was in proportion with the acquisitions. Companies that had an interest in the realization of the bioethanol project lent money to HP Investment to buy the land,” he said.

He could not explain why the financial reports showed that — even accounting for its modest profits — HP Investment’s reported debt of about €688,000 would not cover the €922,000 it spent on the land. “Maybe something was missed from the accounting data, I can’t give an explanation for this,” he told Direkt36.

A loan also paid for the land bought by HP Agro, he said, but did not provide details. He said his brother’s company in Hungary borrowed some money and that some of it was spent on the 90 hectares, but he could not recall what the company was called.

The Crisis Hits Hard

Despite Bánki’s big plans for Romania, the bioethanol factory he promised in Salonta was never built either.

In September 2010, almost a year after he had promised it would open, Bánki wrote to Salonta’s mayor and local council to explain that the project had been delayed by the recent global financial crisis: “As you know, 2008 brought negative changes to the worldwide economy ... As a consequence, market participants have withdrawn, so we couldn't find partners for the bioethanol factory.”

Bánki’s original bid had not mentioned that he would need additional investors for the project. But in the letter he blamed International Monetary Fund (IMF) loans taken by Hungary and Romania to counter the crisis, adding that he would be unable to find partners for the investment until the financial situation stabilized.

In the letter, Bánki expanded his promises, offering to employ new technology to generate electricity from household waste. Furthermore, he would increase his investment to €91 million and create 20 percent more jobs than he had initially promised. He also promised that the plant would start production in May 2014, but asked that he not be fined for the delay, arguing that he couldn’t afford to pay the fines due to the economic crisis.

Although HP Investment still had no employees, Salonta officials gave Bánki another chance, fixing new deadlines for the investment plan and cancelling the penalties owed up to that point. However, the modified contract stipulated that penalties would be calculated starting from 2014 if the investment wasn’t finished.

Despite the dispute, Bánki remained active in the town’s public life. In 2010, together with the local Democratic Alliance of Hungarians in Romania, he founded the Bocskai Award “to highlight the work of Hungarians” to be given annually to those “that have done a lot for Salonta.” In 2011, Bánki handed the award to a local folk dance group at a charity event also attended by Salonta Mayor László Török.

Meanwhile Bánki was making real estate deals in Hungary. In 2008 or early 2009, he sold a 95-square-meter apartment, and that summer he and his wife invested over €360,000 to buy a real estate company, B6 Home Kft. Among the company’s assets was a 133-square-meter flat in a gated northern Budapest community called Roman Wellness Home, overlooking the Danube with a well-maintained park, playground, and swimming pool.

Bánki never listed this flat in his asset declarations. He told Direkt36 that he did not have to because it was owned by his company, not by him personally. Bánki sold B6 Home in 2012, but his wife owns two other flats in the same gated community through yet another company.

Bánki told Direkt36 that he only “halfway” lives in the Roman Wellness Home, as he also spends “two to three” days per week in his constituency in the south of Hungary.

Two Million in Public Debt

Under the modified contract, Banki’s company was supposed to begin work on the bioethanol factory in March 2012. However, when it missed that deadline as well, Salonta officials lost patience and reimposed the original terms, asking Bánki to settle his debts.

By this point, HP Investment had accumulated €2.3 million in penalties for missing the original deadline, and had also failed to pay €43,000 in property taxes. The local authorities asked a judge to declare the company bankrupt. “We have no guarantee that we can recover the money” in any other way, their complaint stated.

The court agreed, and transferred HP Investment’s land in Salonta, which the company had previously bought for more than €390,000, to the local authority to satisfy the €2.3 million debt. The companies that Bánki said lent him the money to buy the land did not appear in the court documents.

“Those companies had already failed [due to the economic crisis], they went bankrupt before our insolvency procedure,” Bánki told Direkt36. HP Investment was deleted from Romania’s Register of Commerce in 2014.

Laszlo Török, the Salonta mayor who signed all the contracts with Bánki’s company, didn’t answer calls or messages from reporters. When they visited the town hall in August to talk to him in person, he wasn’t available.

Selling to Himself

Bánki’s other company, HP Agro, also ran into financial trouble. In 2012, went into insolvency due to over €3,600 in unpaid taxes to state institutions in Satu Mare. As of this year, the company no longer exists.

Court documents in Satu Mare suggest that Bánki tried to salvage the HP Agro land for himself.

In 2013, Bánki founded yet another company, Agro Future Salro, in which an employee of the Salonta municipality, László Sándor Szathmáry, was a minority shareholder (Bánki owned 90 percent while Szathmáry owned 10 percent).

Bánki asked Szathmáry to “do things for him” in Romania, a relative of Szathmáry told reporters when they visited Agro Future Salro’s Salonta address in August. It appeared to be a family home.

Szathmáry did not answer Direkt36’s phone calls and emails.

In 2014, Bánki bought 90 hectares of the HP Agro land through Agro Future Salro for just €29,545 euro, far below the assessed value of €285,700. According to the court files on the HP Agro insolvency proceeding, Agro Future was rebuffed when it tried to register the land at the Cadastral Office because it did not submit a purchase contract for the deal.

Asked about the low price, Bánki told Direkt36 that he had paid the same amount for the land at the time of the purchase, but offered no proof for this assertion. According to a price list established by the National Public Notaries Union for 2008 and 2009, the value of just 65 of the 90 hectares in question was at least 227,500 lei (€63,000) during this period.

After an independent evaluation in 2016 by the National Association of Authorized Evaluators in Romania concluded that the land was worth almost 10 times more than he had paid for it, Bánki’s new company stepped back from the deal and it was cancelled. Lucica Rus, who represents the Romanian liquidator of HP Agro, confirmed to RISE Project that the deal fell through over the price discrepancy.

On July 12, HP Agro’s land was sold to a company called Artiplet SRL for €309,628. According to the Official Gazette, most of the money went to Banki. HP Agro was deleted from the state Registry of Commerce.

Artiplet SRL is owned by Ioan Robert Erdei. Contacted by phone, Erdei confirmed he bought the land from HP Agro, noting he negotiated with intermediaries and never met the owner. Told the seller is a Hungarian politician, he said that was news to him. “I don’t know him,” he said.

He does recall that Szathmáry, who still works in the mayor’s office, represented HP Agro, but says he does a lot of business and doesn’t remember hearing anything about the bioethanol project, which puzzled him. “I am in agribusiness, and I am interested in such projects to have a place to sell what we produce … but I heard nothing about it.”