On the surface, the deals are typical of Ukraine’s arms trade with Africa, where instability and fears that weapons may migrate into conflict zones mean many countries have trouble buying from Western manufacturers.

Ukraine, a former Soviet republic that is not a member of the European Union (EU), is often more than willing to fill the gap in the market.

But this time, there was a hitch: The vehicles were not really Ukrainian.

Rather, a tranche of leaked documents shows something more startling. The vehicles, worth at least US$ 4.1 million, were bought in Poland, an EU member state governed by strict arms export rules. They were sent to Ukraine in parts, and then 45 of them were exported to East Africa via the United Arab Emirates (UAE).

In other words – much like dirty money passing through a series of accounts – the vehicles were laundered to obscure their origin, route, and destination.

The deals are an example of an extensive weapons laundering scheme uncovered by the Organized Crime and Corruption Reporting Project (OCCRP).

Documents obtained by OCCRP reveal how Ukrainian authorities and companies have made the country a key node in a network that channels Soviet-style arms from Europe to Africa and the Middle East. Many of those weapons originate in countries that are now EU members.

The more than 1,000 pages of documents relate to Techimpex, a private Ukrainian firm that sells, repairs, and upgrades military equipment, and a related United Kingdom (UK) shell company known as S-Profit. In at least one instance involving S-Profit, the arrangement appears to have facilitated deals that, if implemented, would have sidestepped EU arms embargoes on Sudan and South Sudan. An Amnesty International report released today goes into further detail about S-Profit. (See story: S-Profit and Embargo Busting)

The documents – which run from 2014 to 2016 and include contracts, correspondence, financial information, and the company’s order book – show how Techimpex works with Ukrainian state arms exporters, including Ukrinmash, as well as the country’s arms export regulator, known as the State Service of Export Control (SSEC), to carry out the trade.

According to an OCCRP analysis, the documents show that Techimpex engaged in at least 26 arms deals valued at a total of $29.5 million in 2015 and 2016. These included millions earned through the weapons laundering scheme.

The Loophole

At the heart of the export network is a loophole in Ukraine’s regulations that allows for the origins and destinations of weapons to be erased from documents as the arms move around the world.

The documents show that, in February 2016, Techimpex requested from SSEC, the arms export regulator, an extension of a licence giving it the right to import armored vehicle parts from Army Trade, a private Polish firm, for the company’s “own needs.” This means the Polish company could send Techimpex weapons -- often labeled as “spare parts” -- using documents that indicated Techimpex as their final recipient.

But the weapons didn’t stay in Ukraine.

Techimpex then sold the arms to Ukrinmash, the state arms exporter, and its parent company Ukrspecexport. Ukrinmash took a cut of between 9 and 17 percent and then sold them on to its African clients. The shipping documents for 37 of the vehicles showed Ukraine as the original source of the weapons – effectively scrubbing their true origin.

The Techimpex papers show the company scouring Eastern Europe for arms and parts from producers in Poland, Slovakia, Moldova, Bulgaria, Hungary, Romania and Bosnia and Herzegovina.

They also show that the company sold weapons to African, Middle Eastern and Asian markets that included Ethiopia, Korea, Chad, the UAE and Uganda.

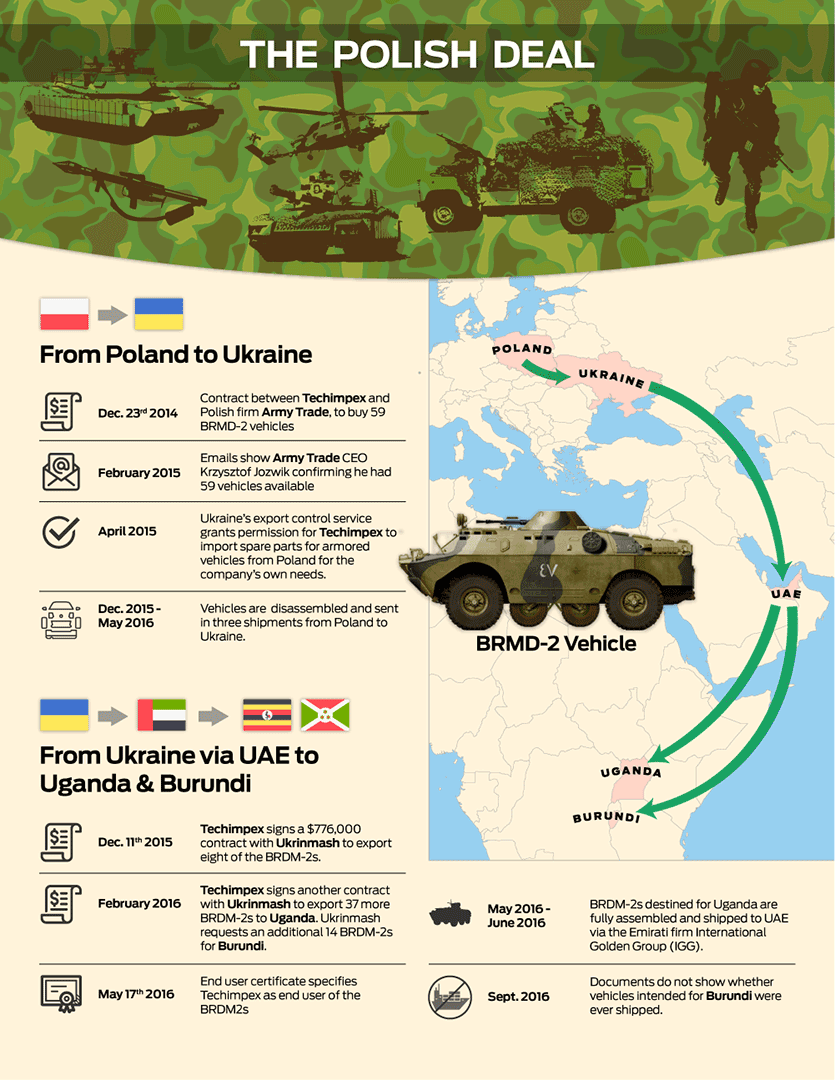

The Polish Deal

The sale of the Polish armored vehicles -- known as BRDM-2s -- demonstrates how the system works.

The leaked documents show that Techimpex signed a contract to buy the 59 BRDM-2s and BRDM-2RHs, as well as machine guns, from Army Trade, on Dec. 23, 2014.

In emails starting in February 2015, Army Trade owner Krzysztof Jozwik confirmed that he had the 59 armored vehicles available. He made no mention of spare parts.

In April of that year, the SSEC granted Techimpex permission to import spare parts for armored vehicles from Poland for the company’s own needs. By December, the shipments began, with the disassembled vehicles crossing by land in three batches, according to Techimpex documents confirmed by data from ImportGenius, a commercial database.

Click to enlarge. (Credit: Edin Pasovic)The documents show that Techimpex had listed itself as the licensed end user of 20 of the BRDM-2s. The end user certificate from May 17, 2016, says that Techimpex would not re-export the arms to a third country “without a permit of the State Service of Export Control of Ukraine [SSEC].”

Click to enlarge. (Credit: Edin Pasovic)The documents show that Techimpex had listed itself as the licensed end user of 20 of the BRDM-2s. The end user certificate from May 17, 2016, says that Techimpex would not re-export the arms to a third country “without a permit of the State Service of Export Control of Ukraine [SSEC].”

In response to reporters' questions, a spokesperson from the Polish foreign ministry wrote that no licenses for exporting BRDM vehicles to Ukraine had been issued in 2014-2015, and that this included "fully assembled BRDM vehicles as well as their parts and components." Since such export licenses have a validity period of 12 months, the spokesman continued, "the shipment on 21-24 December 2015 was perhaps illegal," and requested further information "to enable our special services to launch an appropriate inquiry."

On Dec. 11, ten days before the first of the BRDM-2s crossed the border into Ukraine, Techimpex signed a $776,000 contract with Ukrinmash to export eight of the vehicles.

Techimpex’s order book – a spreadsheet used internally to track the company’s sales – lists Uganda as the final destination.

In February, Techimpex and Ukrinmash signed one more contract to send 37 more vehicles to Uganda. In the same month, Ukrinmash requested an additional 14 BRDM-2s for Burundi.

The documents show that the armored vehicles were not shipped directly to East Africa, but were instead sold to the UAE via an Emirati firm, International Golden Group (IGG). Contracts and shipping documents show that the BRDM-2s destined for Uganda – now fully assembled -- were shipped in two lots in May and June 2016.

The documents, which end in September 2016, do not show if the vehicles intended for Burundi were ever shipped.

The total value of the sales to Uganda was $4.19 million, according to Techimpex’s order book.

Ukrinmash did not respond to repeated requests for comment.

Assent from the State

Jozwik, the owner of Army Trade, told OCCRP that the deal with Techimpex took place as shown in the documents.

“They were spare parts,” he said. He added, however, that the parts comprised the bodies, turrets and engines – in other words, the complete components for the vehicles.

Jozwik said Techimpex had not disclosed to him any plans to sell the vehicles to third countries. He had seen an end user certificate, issued by Techimpex, which showed that Techimpex was the end user.

“I think [the vehicles] were intended for the Ukrainian military,” he said.

But Yevgen Vashchilin, who owns half the company, denied even that the initial sale had occurred as detailed in the documents.

“We import only spare parts [for equipment]. We are not authorized to import [combat-ready] military equipment,” he said. “All these questions are not for us, we don’t do export. We are producers.”

“The state is the one who exercises controls,” Vashchilin continued. “Without the permission of the Export Control Service, no one delivers anything anywhere.”

In a statement to OCCRP, SECU declined to comment on whether weapons were transiting Ukraine on paper without physically passing through the country.

A Sept. 1, 2017 visit to Techimpex's production facility by Ukraine's Deputy Economy Minister, Yuriy Brovchenko (right of center, wearing glasses) who is responsible for the defense sector. Yevgeniy Vashchilin, 50% owner of Techimpex, is wearing the brown jacket. (Credit: League of Defense Companies of Ukraine)

A Sept. 1, 2017 visit to Techimpex's production facility by Ukraine's Deputy Economy Minister, Yuriy Brovchenko (right of center, wearing glasses) who is responsible for the defense sector. Yevgeniy Vashchilin, 50% owner of Techimpex, is wearing the brown jacket. (Credit: League of Defense Companies of Ukraine)

Troubled destinations

Burundi -- the apparent buyer of a portion of the vehicles -- has since 2015 been mired in a political crisis that has killed hundreds of people. The United Nations accused the country’s security forces of using “indiscriminate violence” against anyone suspected of political opposition, following an attack on four military bases in the country’s capital in December 2015.

The International Peace Information Service, an independent Belgian research institute, drew attention to the arms trade corridors into Burundi in a May 2017 report.

While not as volatile as Burundi, Uganda has been noted as a transit point for arms headed into neighboring South Sudan, where a civil war has killed tens of thousands and uprooted millions since December 2013. South Sudan is under an EU arms embargo, making sales to the country by member states illegal.

A UN Security Council panel set up to monitor the embargo has found that Ukrainian firms have sold millions of dollars’ worth of attack helicopters and jets to South Sudan’s government since the outbreak of the war, with Uganda used as a waypoint.

When notified by reporters of the Polish BRDM-2 deal, the EU delegation to Uganda responded in a written statement that it “has noted with great concern that the UN Panel of Experts on South Sudan has documented a number of cases where weapons sold to Uganda have subsequently been diverted to South Sudan.”

“This issue has been discussed by the EU Member States, whose arms export licensing authorities take this risk into account when considering requests for arms export licenses to Uganda."

Cut-Price Arms Deal in Moldova

The deals with Uganda and Burundi are just a small portion of the questionable weapons deals done by Techimpex and Ukrinmash.

For instance, in early 2016, Techimpex’s UK shell firm, S-Profit, acquired three surface-to-air missile (SAM) systems from a state-owned Moldovan airport, Marculesti International Airport. S-Profit was the only bidder on the tender, where the starting price was set at $600,000 for all three systems, according tender documents and a public announcement by Moldova’s Ministry of Defense. Local press reported that S-Profit paid $660,000.

The deal was protested at the time by Moldovan veterans, who said the SAM systems were worth as much as $10 million each. (The Moldovan government has maintained their service life had expired, thereby explaining the low price.)

In an interview, Techimpex’s Vashchilin denied that his company bought any weapons in Moldova, and re-asserted that it only imports weapons parts.

However, Techimpex’s inventory lists tout two surface-to-air S-125M1 missile units, the same model as those sold by Moldova’s airport.

A draft contract between S-Profit and Ukrinmash shows the systems being offered to the arms exporter for $6 million each -- almost 30 times higher than they were purchased for.

Legal Trouble

An S-125 surface-to-air missile system of the same kind purchased by S-Profit from Marculesti International Airport. (Credit: US Navy)In 2016, Techimpex signed a contract to acquire 11 MT-LB armored vehicles from Bulgarian state arms firm Kintex, declaring itself as the final user and claiming that the vehicles were in fact spare parts intended for “repair and maintenance of track vehicles, vehicles for the agricultural sector and vehicles used for emergency and rescue operations in rough country areas.” But customs data by Import Genius, a commercial database, does not show that the delivery took place.

An S-125 surface-to-air missile system of the same kind purchased by S-Profit from Marculesti International Airport. (Credit: US Navy)In 2016, Techimpex signed a contract to acquire 11 MT-LB armored vehicles from Bulgarian state arms firm Kintex, declaring itself as the final user and claiming that the vehicles were in fact spare parts intended for “repair and maintenance of track vehicles, vehicles for the agricultural sector and vehicles used for emergency and rescue operations in rough country areas.” But customs data by Import Genius, a commercial database, does not show that the delivery took place.

Techimpex’s list of inventory circulated to a Saudi Arabian company shows the company touting 30 such vehicles, with optional upgrades.

The deal attracted the attention of Ukrainian law enforcement. In May 2016, the country’s Security Service sent the firm a request, seen by OCCRP, to supply all documentation related to its work with Kintex.

Techimpex has also faced questions over its Ukraine-sourced inventory.

The Security Service opened an investigation in 2014 into allegations that the company obtained a large quantity of military inventory for knock-down prices during the reign of deposed pro-Russian President Viktor Yanukovych. The investigation is examining allegations that three sales of military equipment which took place in 2011 cost Ukraine the equivalent of about 57.3 million hryvnia ($7.2 million) in losses.

In total, between 2010 and 2013, Techimpex acquired 154 armored personnel carriers, 27 tanks, four military helicopters, one transport plane, over 1200 machine guns, 29,400 AK-47 assault rifles and 35,000 rifles from Ukrainian military surplus, according to data provided by Ukraine’s defense ministry in 2015 in response to an MP’s request.

Close Relationships

The Techimpex papers show that the firm enjoys an unusually close relationship with state firms and regulators, even by the cozy standards of Ukraine’s defense industry. The relationship is even more remarkable for a private firm founded in 2003 in a branch of the economy dominated by state-owned Soviet-era arms companies.

Part of this may be personal. Techimpex’s owner, Yevgeniy Vashchilin, had worked at Ukrinmash until 10 years ago, he disclosed in an interview.

His father (and Techimpex’s co-founder) Viktor Vashchilin headed SSEC, the arms export regulator, in the 1990s.

The younger Vashchilin denied to OCCRP that his firm receives special treatment.

“We work equally with almost all the state exporters,” he said.

“We, as producers, are only allowed to work via these corrupt [state export company] structures,” he said. “I don’t want to work with any of them, I want to work directly [with end customers].”

But the Techimpex papers suggest a closer relationship than that. In a December 2015 draft document discussing contract terms between Techimpex and the company’s UAE lobbyist, Ismael Houmany from ASTA, an unnamed Techimpex representative confirmed that the firm was charged the lowest possible commission Ukrinmash was allowed to charge by the law. The document refers to a “Dmytro” whose identity is unclear.

“With other companies they [Ukrinmash] charge higher but thanks to Dymtro positive involvement they keep it at the minimum possible level – 10% only,” the Techimpex representative wrote. Below that, Houmany wrote a comment: “Agreed. Thanks to Dmytro”

The Techimpex order book shows that the company pays between nine and 12 percent commission to Ukrinmash on most of its shipments. This is far less than the over 30 percent it typically pays to Ukrspeceksport, another state firm.

An internal Techimpex document shows that the head of Techimpex’s purchasing department, Oleksandr Radivanovich, was assigned to an unspecified position within the defense ministry in 2015.

In the document, Techimpex’s deputy head, identified as V. I. Shevchuk, asked company CEO Volodimir Kalina to give Radivanovich a 100 percent bonus on his salary “in connection with his performing additional functions related to work in Ukraine’s Ministry of Defense.”

In an interview, Radivanovich denied that he worked for the defense ministry at the time.

A spokesperson for the defense ministry declined to answer questions from OCCRP, saying the ministry did not comment on personnel matters.

For Artem Davydenko, an analyst at Transparency International in Ukraine, the relationships revealed in the Techimpex documents are typical of Ukraine’s murky arms export system.

“In practice the whole system doesn’t seem to work in an unbiased manner – only a few non-state companies receive licenses to import/export military goods,” Davydenko wrote in response to questions.

“The lack of transparency in these internal documents makes it impossible to understand how exactly this is regulated, and to what degree individuals can influence it.”

Additional reporting by Inna Civirjic in Chisinau, Moldova; Marcin Sonnenberg in Warsaw, Poland; and Anna Babinec in Kyiv, Ukraine.