Maltese Prime Minister Joseph Muscat was enthusiastic as he addressed the annual London meeting of Henley & Partners, an international law firm, on Oct. 31, 2013.

“Our focus is on the attraction of extremely highly talented and networked people from around the world by offering them the possibility of sharing the Maltese and European journey that we as a nation will make in the future,” he said.

Less than three months later, Malta was offering Golden Visas for sale under a scheme designed by the firm, which bills itself as “the Global Leader in Residence and Citizenship Planning.”

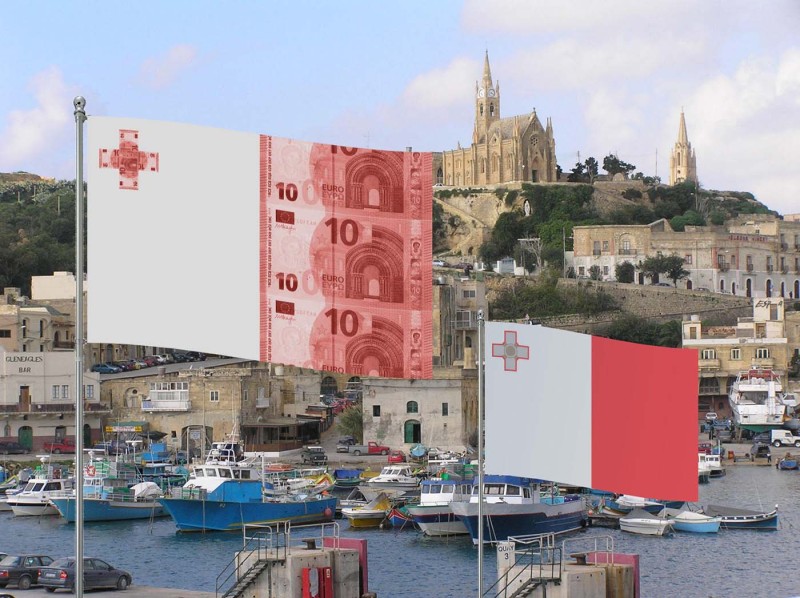

Golden Visa is the industry term for citizenship-by-investment programs, in which wealthy foreigners can obtain legal residence or even citizenship in new countries in exchange for substantial amounts of money. Originating more than 30 years ago in the Caribbean, such schemes have spiked in popularity in the past decade and are now offered in more than 20 countries.

The programs have come under fire for making it too easy for organized crime figures, tax-evaders, and people whose wealth can’t be easily explained to join the stream of legitimate global businesspeople and other rich individuals who simply want more freedom to travel and invest. Some also feel that being able to obtain citizenship by virtue of wealth is neither fair nor desirable.

A report last December by Transparency International’s Russia chapter identified a number of Russian officials and wealthy businessmen who have obtained Maltese passports.

Since then, three Russian billionaires who obtained passports in 2016 — Arkady Volozh, Boris Mints, and Alexander Nesis – have been named on the so-called Kremlin List published by the White House on Jan. 30. It is not a sanctions list, but identifies Russia’s richest businessmen who are believed to be close to Putin. (See: The Dubai-ification of Malta)

Malta’s scheme came as a surprise to its people, who had not expected the government to choose this tool to attract investments. Muscat’s Labor Party did not include it in its 2013 political campaign program.

According to a report issued by the Office of the Maltese Regulator, Malta’s 1,101 new Individual Investor Program (IIP) citizens have indeed been a financial boon. Since the program began, it has produced more than €850 million for the Maltese economy, nearly €395 million of that between July 1, 2016, and June 30, 2017.

The program has helped move the country’s budget from deficit to surplus, according to the International Monetary Fund (IMF).

“The fiscal balance is estimated to have registered a surplus for the second consecutive year in 2017, thanks to buoyant revenues—including from Individual Investor Program proceeds,” the IMF noted in January.

Nevertheless, the secretive program has been heavily criticized both on the island and by the EU, which has pushed Malta to make a number of changes, such as publishing the names of its new citizens. In 2017, the government did publish a list for 2016, but it also included those who married Maltese, had a Maltese parent, or were born abroad of Maltese descent, making it impossible to identify who had bought Golden Visas.

The main opposition Nationalist Party says the Labor government is selling out Maltese identity. It claims that most of the new citizens have no real connection to the island and are just seeking low taxes and visa-free travel to the EU.

Last December, Ana Gomes, a member of the European Parliament from Portugal and a leading critic of Golden Visa policies, led a delegation to Malta to investigate allegations of governmental shortcomings on several fronts, including the fight against “money laundering, tax avoidance and tax evasion” — and the country’s Golden Visa scheme.

The delegation noted in its report that Malta’s Financial Intelligence Analysis Unit acknowledged “an element of risk in the scheme” but received only a few suspicious transaction reports (formal notifications required to launch investigations into the origin of money used to pay for Maltese citizenship).

Henley and Malta, the Best of Friends

The bonds between Malta and Henley & Partners, the London-based “citizenship planning” firm, run deep.

Henley & Partners has several offices on the island and calls Malta’s program the best citizenship-by-investment program in the world — perhaps not surprisingly, since Henley helped design it. The firm is also the program’s “unique concessionaire,” meaning it signed a contract with the government to implement, administer, and promote it.

The contract was signed by Malta’s Permanent Secretary Kevin Mahoney and Henley representative Hugh Morshead in September 2013, but was only made public in 2015. No information on the financial details or duration of the deal were released.

The delay may have stemmed from initial European opposition to Malta’s program. Between December 2013 and January 2014, the program was the focus of talks between the government (supported by Henley & Partners) and several European institutions.

The European Parliament was strongly against its introduction. Sven Giegold, a German member representing the Green Party/European Free Alliance, still opposes it today. “Citizenship is something which is not for sale,” he says. “That is a principal position for me. Malta, together with other countries, has turned citizenship into a tradable good.”

On Jan. 16, 2014, the parliament issued a resolution stating essentially those concerns. But on Jan. 29, the European Commission approved Malta’s program after the government agreed to several changes, including adding a residency requirement of one year before citizenship is granted and publishing the list of new citizens.

How to become a Maltese citizen

Malta’s Golden Visa program is not cheap.

Each applicant must pay the government €650,000 to file the main application, plus €25,000 for a spouse; €25,000 for each dependent child under 18; €50,000 for each child 18-26; and €50,000 for each dependent over 55.

A family with two young children and two grandparents would face an initial bill of €850,000.

Government officials say 90 percent of that application fee is split between the National Development Social Fund (NDSF) — a fund set up in 2016 under the Ministry for European Affairs and Equality to collect money for social projects — and the government’s consolidated fund.

The remaining 10 percent is split between Identity Malta, a government agency which gets 6 percent for handling identity documents, and Henley & Partners, which gets 4 percent for “marketing and processing fees.”

Applicants must also invest €150,000 in five-year government bonds (for which Henley & Partners gets another 4 percent commission) and either buy a property worth €350,000 or rent one for at least €16,000 per year for five years. Conveniently, Henley also runs a real estate company in Malta which sells and rents properties to new citizens.

Applicants must also pass “due diligence” background checks into their criminal history, how much money they have, and whether it was legally obtained.

As the only authorized provider of Maltese Golden Visas, Henley & Partners collects additional fees for assisting with these requirements. It charges each client €70,000 for its services, with additional fees for spouses and children. These are not clearly spelled out in any public agreements.

Henley contracts the due diligence work out to 167 other law firms approved by Identity Malta, which itself does background checks as well. After one year, assuming the applicant passes the background checks, he or she becomes a Maltese citizen. Identity Malta’s “stringent due diligence” results in a rejection rate of around 20 percent, according to the IMF.

In cases where there are suspicions of money laundering or links to organized crime, Malta’s Financial Intelligence Analysis Unit investigates the bank accounts and the origin of the investors’ money.

The government website that explains the Golden Visa scheme states that the first requirement is a clean criminal record. The second requirement is to buy or rent real estate — which has helped push up average rents on the island by 47 percent, from €647 to €957, over the past four years.

It appears most applicants opt to rent rather than buy. According to Transparency International-Russia, of 143 investors who had received Maltese passports under the investment scheme as of April 2016, 116 signed a five-year lease contract and only 27 purchased property.

Many new investors rent properties in Northern Harbor, a wealthy area just north of the capital of Valletta. Rents there increased from an average of €721 per month to €1,074 between 2013 and 2017 — in a country where the median monthly wage is around €1,400.

The requirement to invest €150,000 “in bonds or shares sanctioned by the Maltese government” arose out of talks with the opposition party in 2013, when the government was asked to introduce criteria to establish “genuine links” between applicants and the island.

Vistra is one of the financial services companies that does due diligence work for the program. According to its website, such “links include, but are not limited to, property purchase or leasing; investment in government bonds; a business relationship in Malta; the opening of a company office; and/or employment of Maltese individuals.”

The program’s critics say that, in reality, some applicants don’t have much connection to the island. “They come twice, once to get a residency card and once to get a passport,” Mark George Hyzler, an immigration lawyer, told the New York Times in 2015.

Keep it or End it?

When Malta’s Golden Visa program was launched, the government said it would be shut down after 1,800 applicants had become citizens. With the tally currently just past 1,100, it is not clear whether that will happen.

Earlier this year, the Maltese government decided to ask its people to vote on whether they want to extend the program by responding to an online survey. The public consultation process closed on Feb. 28 but no results have been released, though Identity Malta promises a report “in the coming weeks.”

Voters were asked to weigh in on eight questions, including whether the number of applicants should be capped (no limit was specified) or whether it should “be left open at the discretion of Government.”

They weren’t asked whether the program should be ended entirely, although the last question provided a way for opponents to register objections: “Do you have any additional comments or recommendations which you would like to put forward to enhance the Individual Investor Program?”

Without the program, “Malta doesn’t have a financial surplus,” says sociologist and political activist Michael Briguglio, who is also a local councilor from the main opposition Nationalist Party. He says the money is invested in the public sector to create new jobs.

“This scheme is the only reason why the government can expand the public sector without a deficit,” he says. "Malta is generally split in two, as it was from the beginning of the citizenship-for-sale program. The proposal was controversial.”

Matteo Privitelli is executive director at Core Platform, which promotes corporate social responsibility (CSR) in small and medium enterprises. Core Platform is under the patronage of Malta’s president, Marie Louise Coleiro Preca.

Privitelli believes public sentiment backs the program. “People on the street say they don’t care if Malta’s name is thrown under the bus. …The economy is doing well.”

The 2017 assassination of investigative journalist Daphne Caruana Galizia damaged the reputation of the island, Privitelli says, adding that without "more enforcement”, the island will be attractive for “shady businessmen.”

This story was produced as part of the Global Anti-Corruption Consortium, a partnership between OCCRP and Transparency International.