Gilbert Mvondo is still waiting to be paid for carving dirt roads through the Cameroonian rainforest, where foreign investors promised to create jobs cultivating cannabis and other crops for export.

Residents of the southern region of Meyomessala were recruited in early 2016 by local officials to prepare the ground for representatives from the prime minister’s office and visitors from a London firm.

“We were all involved in digging roads that made it easy for the delegation to move within the forest,” said Mvondo, a member of the Bulu indigenous group. “No one paid us and until today they still owe us.”

Locals say they abandoned their farms, as an area larger than the size of Central London was set aside for a “modern, technology-driven agriculture export free zone,” according to the investors’ promotional materials.

Today, jungle is encroaching on those roads. Neither the jobs nor the hemp plantation have materialised, and the people have gone back to farming.

According to interviews and internal documents viewed by reporters at OCCRP, South China Morning Post, and NBC News, hundreds of thousands of dollars appear to have been spent on the project — yet it is unclear where the money went.

“Unfortunately our exchanges did not give anything,” said the mayor of Meyomessala, Christian Mebiame Mfou'ou, in an email to reporters, lamenting the project’s demise. He did not reply to questions about an investor from Equatorial Guinea, who said he had wired more than $300,000 into the mayor’s personal account.

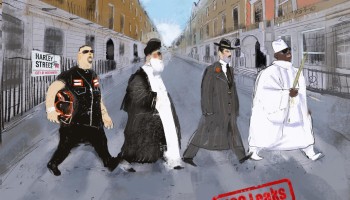

Information about the project comes from a cache of internal documents from London-based company services firm Formations House, which was obtained by the information activist group Distributed Denial of Secrets and shared with journalists. The documents reveal the company’s communications with local officials and foreign investors, and its lofty business plans for one of the poorest countries in the world.

In an email response to journalists, Formations House owner, Charlotte Pawar, said the leaked data has been reported as stolen, and that the firm has faced extortion attempts. She did not provide evidence for the claims, despite requests from reporters.

Formations House came up with the Cameroon cannabis concept after already having created tens of thousands of companies for global clients. By 2016, the firm – operating through Hong Kong-registered Trade Park Corporation – had spent about half a decade pursuing a bold strategy to build a constellation of offshore zones in Africa and the Balkans. The proposals varied, but often featured company registries, which the firm would run without oversight.

Hiding Out in Hong Kong

Trade Park’s nominal presence in Hong Kong, which boasts a reputation for ease of doing business due to light regulation and low taxes, has once again drawn attention to due diligence standards in the international finance hub.

The registries would be some of the most opaque in the world. In one presentation, Trade Park advertised: “Total anonymity provided, with no visibility to U.S. or international institutions.” In São Tomé and Príncipe, Trade Park pitched a private commerce registry with an ability to issue financial and banking licences. It would become a “direct competitor to [the] Seychelles."

The most audacious plans materialized in the West African nation of Gambia, where they used an unauthorised registrar to form hundreds of companies, including fake banks, some of which have been used in multimillion-dollar fraud scams.

While Formations House may not have promoted the plans with criminal intent, it engendered an environment that allowed criminality to flourish unfettered by law enforcement – whether on the sun-soaked shores of Gambia, or in its own office in Central London.

In Cameroon and a handful of other African countries, Formations House offshoot firms also sought to convince government officials to tap into the growing global market for medical marijuana extracts. Had they succeeded in Cameroon, the project would have slashed almost 5,000 hectares of rainforest, and potentially enabled corruption. Indeed, the leaked emails reveal unorthodox payments to officials even in the planning stage.

The project would have focused on producing cannabis oil in order to “establish Cameroon as a destination for the Agricultural Pharmaceutical industry.” Business plans show that would have required “ethical deforestation” of protected rainforest and “ethical rehoming of wildlife,” which would likely include endangered species such as western lowland gorillas, chimpanzees and leopards.

African Promises

In some countries — including Chad, Malawi and Gabon — Trade Park piqued the interest of government departments as high up as ministries and presidential offices. The promised benefits for local authorities were typically grandiose.

In Chad, Trade Park claimed that an agricultural zone would, within three years, create 30,000 jobs and generate $357 million in net revenue for the government — which at the time would have been 3.3 percent of the country’s gross domestic product. Trade Park told government officials it could be up and running within a mere 30 days of signing contracts.

There is no indication that the company’s plans for Madagascar, Mozambique, São Tomé and Principe, and Equatorial Guinea came to fruition. And despite some inroads in Chad, Malawi, Gabon and Cape Verde, it appears that the Trade Park project that came closest to becoming operational was in Meyomessala, Cameroon.

The region is at least a four-hour drive from the capital, Yaoundé. It also happens to be the birthplace of President Paul Biya, who has ruled the country since 1982.

“The choice of the locality was not in vain,” noted Jacques Roger Dougueli, Pawar’s employee in Cameroon, in a June 2016 email to her.

Trade Park sold the concept of Meyo AgriPark as a would-be “world class export zone” that would “provide the optimal environment” for foreign investment by companies eager to capitalize on a $500 billion-a-year global agro-pharmaceutical market.

The company promised to create 15,000 jobs within three years and to bring in $300 million of foreign direct investment from companies that would be lured by the zone’s special permission to cultivate cannabis, which is otherwise illegal in Cameroon. It claimed to have received an “exclusive and perpetual government approved license” to grow the crop.

An unsigned contract states that the license was obtained with support from Meyomessala Rural Council in collaboration with the Yaoundé-based Institute of Medical Research and Medicinal Plants Studies. Meyomessala Mayor Mebiame Mfou'ou stopped communicating with reporters and did not answer questions about the license.

Trade Park also promised to build an employee healthcare center and an academic institute, plus improve local infrastructure, according to an unsigned contract.

That was welcome news for local impoverished communities. Many roads in the area are only negotiable by motorcycle and people commonly hunt, fish and farm cassava and plantains to survive.

“They told us we were going to make a lot of profit if we started farming medicinal plants to sell to the white man. But the council has gone cold on it,” said one resident, who did not wish to be named, referring to the Meyomessala local government. “We don't know what to think.”

Money Talks

Located less than 10 km from President Biya’s private compound, the project read like a great deal for the government. It would require no direct funding from the state, relying instead on international investment.

To raise the $50 million she said she needed, Pawar proceeded to court foreign investors with deep pockets. A December 2016 “projects update” includes loose commitments she claimed she got from potential investors including the global accounting firm PwC, the French investment bank Société Général, the African banking conglomerate Ecobank, and Net Oil, a Cameroonian petroleum exporter.

There is no evidence that any of those institutions actually invested, but emails show that some funds did flow into the project. While it’s unclear exactly how much money was spent, the total appears to be in the hundreds of thousands of dollars.

A Kuwaiti businessman bought about $250,000 worth of shares in Trade Park in December 2015 as investment, but later he soured on the project. In a letter demanding a refund, his lawyers claimed he had been misled by the promise of “astoundingly spectacular” returns of $4.3 million in year three, and called the content of a promotional brochure “nothing less than science fiction.”

In an emailed response to questions from reporters, Pawar said the businessman’s “decision to invest was based on his verification of the project and its licences.”

Another businessman from Equatorial Guinea told reporters he transferred CFA 200 million (about $336,000) to the personal bank account of Meyomessala Mayor Mebiame Mfou'ou to pay for the land that had been designated for Meyo AgriPark. George Kaiafas said he sent the money on the understanding it would be distributed to local community — but was still awaiting documentation to prove his ownership.

Kaiafas initially said he would provide journalists with transaction records, but then stopped responding to questions. One 2017 email indicates he paid about $64,000 as a starting investment in the project.

Pawar and her colleagues also spent tens of thousands on the project, according to the leaked documents. Bank statements show she transferred 55,000 euros ($65,450) in two payments to International Business Company in December 2015 and March 2016. That company, which owned half of Trade Park Corporation Cameroon Limited together with Trade Park Corporation, was operated by Dougueli, Trade Park Cameroon’s general manager.

A month after receiving the second payment, Dougueli emailed Pawar to say he had to pay nearly $10,000 to a private company to obtain an operating license from Cameroon’s National Office of Free Industrial Zones (NOIFZ). NOIFZ had rejected their proposal, he said, citing a “bad market study,” a “low [weak] financial study” and a “weak business plan.” To resolve those issues, NOIFZ recommended asking “their private consulting firm” to “edit” the proposal — for a fee that Dougueli had to negotiate.

“I fought with great difficulty to settle after the editing of the project [t]he amount of 9,000 euros,” wrote Dougueli, who did not respond to requests for comment.

Later in 2016, Pawar’s business partner, Frederic Bard, told her that he had to send the mayor and company “100 k” to keep them patient, adding: “I need to feed the beast…”

Pawar responded saying it wouldn’t be the first such payment. “We paid them money initially, and that was tough for us but we did it, and then they asked for more and then said they had already spent it and needed it replacing,” she wrote. “I do think that even if I manage to find 100k now they will find more reasons to ask for more and make this [a] problem.”

In a January 2017 email to her coworkers Pawar estimated, “we have spent around 500k eur already” (about $550,000) on the project.

But the payments did not seem to satisfy Mayor Mebiame Mfou'ou who, according to an unsigned contract, may have stood to make 10 percent of license fees from the park. In September 2016, he contacted Dougueli to lambast Trade Park’s handling of the project, for which he had taken “enormous risks” and lobbied the “head of state, first lady, other senior government officials, and members of his local community.”

“You gave us commitments that you didn’t honor. It’s extremely frustrating,” he wrote. “I am worried for my political career and my freedom.”

Mebiame Mfou'ou did not respond to questions from journalists about whether he or the local government received any money. Adolphe Nkoumou, who is in charge of local agricultural projects, told reporters that as far as he knew nobody in the local government received even one franc.

The chief of Tatching 2, a village in Meyomessala region, said none of this money reached locals. “It was difficult because some said we had collected 85 million CFA ($142,000),” said Jean Paul Nkomo Nkomo.

“If I had that money, I would not only think of my uncompleted building, but I would sleep at the Hilton for at least one week before thinking about my return.”

High Hopes

Trade Park documents are sprinkled with seductive statements such as this claim about the global market for cannabidiol oil: “Pound for pound, CBD oil is currently more valuable than gold.” The promise of a big payoff from exporting the oil extract from cannabis no doubt helped smooth the way for Trade Park to receive permission to grow the illegal crop, and a license to use a massive tract of rainforest.

Chris Duvall, who chairs the University of New Mexico’s geography and environmental studies department, said the proposal is part of a growing trend of foreign companies looking to Africa for land to grow cannabis to cash in on the burgeoning global market for medicinal extracts. But those investments bring risks.

“There are really very limited environmental regulations and policies in most sub-Saharan countries, and where they exist, a lot of times they’re not enforced,” said Duvall, whose research has focused on the history of cannabis in Africa.

“A lot of times the companies have more access to more wealth, more money than virtually the entire government of some of these countries, and so the power differential is very strong,” he said. “The lack of transparency all around means it’s really difficult to say exactly what’s happening in a specific country.”

In the case of Cameroon, the project’s high-flying ambitions seems to have failed due to lack of investment.

Trade Park’s contract with the Meyomessala government listed more than a dozen international firms that had purportedly submitted bids and tenders for the project, including household names such as British American Tobacco and Bayer AG.

Every one of the companies that replied to requests for comment – including O’Neal, Bayer, Agrilogistics, British American Tobacco and Altria – denied any involvement in the project.

Pawar told reporters in an email that the project is “awaiting investment to proceed.”

In a follow-up response she added that Trade Park had “secured all government approvals and licences” to go forward, and had also set aside funds to pay for a feasibility study on its impact.

“This project would be implemented with the highest levels of environmental safety as possible,” Pawar said.

Today, Meyo AgriPark exists only as a lofty proposal in aged pamphlets and business plans, as well as a scattering of stakes demarcating the boundaries of the proposed site.

But the local government has not given up hope, according to Nkoumou, the municipal council member in charge of agricultural projects. He said some investors from India and Japan had shown interest, without elaborating.

"We are ready to receive any sponsors for the project,” Nkoumou said in an interview, after a day’s work on his farm. “It is a project that will benefit the community."